Image Sensors Market by Technology and Application - Global Industry Analysis and Forecast to 2022

Published On : November 2017 Pages : 100 Category: Sensors & Controls Report Code : SE11329

Industry Outlook and Trend Analysis

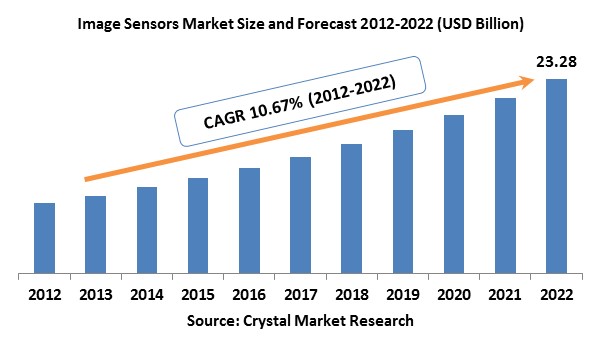

The global Image Sensor market was worth USD 8.45 billion in the year 2017 and is expected to reach approximately USD 23.28 billion by 2022, while registering itself at a compound annual growth rate (CAGR) of 10.67% during the forecast period. The sensing devices are utilized to conquer the degradation of natural light and the quality happens when the pixel estimate is diminished. The expanding requirement for devices with smaller pixels giving high resolution with cost-efficiency approach is anticipated to fuel the market development over the estimate time frame. The market has been encountering a significant change over the most recent couple of years. The technological headways and extreme utilization of images crosswise over different applications have driven the change of picture sensors in the worldwide market. With the expanding R&D ventures, sensing equipment has turned out to be less expensive, power efficient, and smaller, offering chances to the business players. The expanding cell phone section, particularly smartphones, is expected to boost the fragment development over the figure time frame. The expanding worries for security and surveillance in parks, open squares, public squares, and malls and the expanding terrorist attacks are the central point expanding the requirement for better determination cameras for security and observation. Nonetheless, the surging requirement for digital still cameras and cell phones has brought about deficiencies in focal points and picture sensors. Moreover, the dynamic idea of semiconductor business may control the section development over the estimate time frame.

Technology Outlook and Trend Analysis

In 2017, the CMOS technology produced the most astounding income and is relied upon to keep up its strength over the predicted time frame inferable from its cost-effectiveness, compact nature, and low power consumption, which makes it perfect for use in different applications. It is utilized as a part of microcontrollers, static RAM, microprocessors, and other analog circuits, for example, highly integrated transceivers and data converters. The CCD technology is required to have an extensive development attributable to the high-cost and high power utilization. CCD innovation can be utilized as a part of different applications requiring an additional affectability of the electron multiplying CCD.

Application Outlook and Trend Analysis

Image Sensors application portion can be classified into security & surveillance, industrial/defense, automotive, consumer electronics, and medical. In 2017, Consumer electronics ruled the business on the basis of profit. The expansion and implementation of dual cameras in cell phones are relied upon to spur the demand. Additionally, more intelligent and minimized cameras can likewise help in overseeing activity impacting the interest for movement observation cameras which is relied upon to encourage significantly increment the market development. Advanced Driver Assistance Systems (ADAS) is foreseen to be the critical driver for section development over the estimate time frame. Contingent upon the machine vision, the framework responds to the circumstance experienced while driving. However, the technology has discovered a huge move toward the pervasiveness crosswise over other auto portions. The requirement is additionally anticipated that would boost attributable to the stringent administrative standards focusing to enhance street security for pedestrians and drivers over the gauge time frame. The developing requirement for solutions that are minimally invasive and imaging methods is foreseen to drive the request in therapeutic applications. CMOS has opened new views to minimally invasive medical devices, for example, wireless capsules that are utilized for the observation of the gastrointestinal tract. The expanding per capita healthcare spending is relied upon to build the interest for the fragment in the medical application. As indicated by the World Bank report of 2017, the United States had a for each capita healthcare spending of around USD 9403. The 3D imaging technology is broadly acknowledged in the medical and healthcare industry for better perception and enhanced imaging. The developing acknowledgment among surgeons and radiologists and the expanding utilization of ultrasound 3D imaging in oncology and cardiology is foreseen to impact the requirement for imaging market over the figure time frame.

Regional Outlook and Trend Analysis

The Asia Pacific area is required to remain the key income creating locale, representing the biggest share in the following years. Positive consumer inclinations alongside the existence of an expansive number of producers in the area are a few components representing the vast offer. The area is expected to be the biggest market sooner rather than later attributable to the change from analog to digital systems. The region of Asia Pacific is foreseen to witness a noteworthy requirement, especially in China and India, in view of the accessibility of economy and in addition high-end luxury vehicles. The developing framework advancement and government activities toward security at open places in locales, for example, India are foreseen to expand the interest for industry. The legislature driven activities, for example, Make in India and Digital India, are foreseen to help the penetration of cell phones and other shopper gadgets in the locale, bringing about expanding the business request.

Competitive Insights

Advancement, new item improvement, and redesigns alongside the incessant launch of new items will be the key development methodologies for the business players in the upcoming years. The major players in the market are ST Microelectronics, Sony Corporation, Canon, Inc, Samsung Electronics Co., Ltd. and Panasonic Corporation. Merger and acquisitions among the players is likewise thought to be one of the technique executed for building up the upgraded item in the business. For example, one of the significant business players, Sony Corporation, procured Toshiba Corporation’s image sensor unit in 2017.

The Image Sensor Market is segmented as follows-

By Technology

- CCD

- CMOS

By Application

- Industrial/Defense

- Automotive

- Medical

- Security &Surveillance

- Consumer Electronics

- Others

By Region

- North America

- U.S

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- Japan

- China

- Australia

- India

- South Korea

- Rest of Asia Pacific

- Rest of the World

- Brazil

- South Africa

- Saudi Arabia

- United Arab Emirates

- Others

Some of the key questions answered by the report are:

- What was the market size in 2017 and forecast from 2017 to 2022?

- What will be the industry market growth from 2017 to 2022?

- What are the major drivers, restraints, opportunities, challenges, and industry trends and their impact on the market forecast?

- What are the major segments leading the market growth and why?

- Which are the leading players in the market and what are the major strategies adopted by them to sustain the market competition?

- Image Sensor Market, By Technology, Estimates and Forecast, 2012-2022 ($Million)

- CMOS

- CCD

- Image Sensor Market, By Application, Estimates and Forecast, 2012-2022 ($Million)

- Automotive

- Consumer Electronics

- Security &Surveillance

- Industrial/Defense

- Medical

- Others

- Image Sensor Market, By Region, Estimates and Forecast, 2012-2022 ($Million)

- North America

- North America Image Sensor Market, By Country

- North America Image Sensor Market, By Technology

- North America Image Sensor Market, By Application

- U.S. Image Sensor Market, By Technology

- U.S. Image Sensor Market, By Application

- Canada Image Sensor Market, By Technology

- Canada Image Sensor Market, By Application

- Mexico Image Sensor Market, By Technology

- Mexico Image Sensor Market, By Application

-

- Europe

- Europe Image Sensor Market, By Country

- Europe Image Sensor Market, By Technology

- Europe Image Sensor Market, By Application

- Germany Image Sensor Market, By Technology

- Germany Image Sensor Market, By Application

- France Image Sensor Market, By Technology

- France Image Sensor Market, By Application

- UK Image Sensor Market, By Technology

- UK Image Sensor Market, By Application

- Italy Image Sensor Market, By Technology

- Italy Image Sensor Market, By Application

- Spain Image Sensor Market, By Technology

- Spain Image Sensor Market, By Application

- Rest of Europe Image Sensor Market, By Technology

- Rest of Europe Image Sensor Market, By Application

-

- Asia-Pacific

- Asia-Pacific Image Sensor Market, By Country

- Asia-Pacific Image Sensor Market, By Technology

- Asia-Pacific Image Sensor Market, By Application

- Japan Image Sensor Market, By Technology

- Japan Image Sensor Market, By Application

- Australia Image Sensor Market, By Technology

- Australia Image Sensor Market, By Application

- India Image Sensor Market, By Technology

- India Image Sensor Market, By Application

- South Korea Image Sensor Market, By Technology

- South Korea Image Sensor Market, By Application

- Rest of Asia-Pacific Image Sensor Market, By Technology

- Rest of Asia-Pacific Image Sensor Market, By Application

-

- Rest of the World

- Rest of the World Image Sensor Market, By Country

- Rest of the World Image Sensor Market, By Technology

- Rest of the World Image Sensor Market, By Application

- Brazil Image Sensor Market, By Technology

- Brazil Image Sensor Market, By Application

- South Africa Image Sensor Market, By Technology

- South Africa Image Sensor Market, By Application

- Saudi Arabia Image Sensor Market, By Technology

- Saudi Arabia Image Sensor Market, By Application

- Turkey Image Sensor Market, By Technology

- Turkey Image Sensor Market, By Application

- United Arab Emirates Image Sensor Market, By Technology

- United Arab Emirates Image Sensor Market, By Application

- Others Image Sensor Market, By Technology

- Others Image Sensor Market, By Application

1. Introduction

1.1. Report Description

1.2. Research Methodology

2. Executive Summary

2.1. Key Highlights

3. Market Overview

3.1. Introduction

3.1.1. Market Definition

3.1.2. Market Segmentation

3.2. Market Dynamics

3.2.1. Drivers

3.2.1.1. Increasing Usage Of Image Sensors in the Automotive Sector

3.2.1.2. Increasing Medical Imaging Market

3.2.1.3. Rapidly Expanding Wearable Industry

3.2.2. Restraints

3.2.2.1. Shortage of CMOS Sensors to APAC Vendors

3.2.3. Opportunities

3.2.3.1. Emerging Markets to Offer Lucrative Growth Opportunities

4. Image Sensor Market, By Technology

4.1. Introduction

4.2. Image Sensor Market Assessment and Forecast, By Technology, 2012-2022

4.3. CMOS

4.3.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

4.4. CCD

4.4.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

5. Image Sensor Market, By Application

5.1. Introduction

5.2. The Image Sensor Market Assessment and Forecast, By Application, 2012-2022

5.3. Automotive

5.3.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

5.4. Consumer Electronics

5.4.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

5.5. Security & Surveillance

5.5.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

5.6. Industrial/Defense

5.6.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

5.7. Medical

5.7.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

5.8. Pharmaceuticals

5.8.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

5.9. Other Applications

5.9.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

6. Image Sensor Market, By Region

6.1. Introduction

6.2. Image Sensor Market Assessment and Forecast, By Technology, 2012-2022 ($Million)

6.3. Image Sensor Market Assessment and Forecast, By Application , 2012-2022 ($Million)

6.4. North America

6.4.1. Market Assessment and Forecast, By Country, 2012-2022 ($Million)

6.4.2. Market Assessment and Forecast, By Technology, 2012-2022 ($Million)

6.4.3. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

6.4.4. U.S.

6.4.4.1. Market Assessment and Forecast, By Technology, 2012-2022 ($Million)

6.4.4.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

6.4.5. Canada

6.4.5.1. Market Assessment and Forecast, By Technology, 2012-2022 ($Million)

6.4.5.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

6.4.6. Mexico

6.4.6.1. Market Assessment and Forecast, By Technology, 2012-2022 ($Million)

6.4.6.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

6.5. Europe

6.5.1. Market Assessment and Forecast, By Country, 2012-2022 ($Million)

6.5.2. Market Assessment and Forecast, By Technology, 2012-2022 ($Million)

6.5.3. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

6.5.4. Germany

6.5.4.1. Market Assessment and Forecast, By Technology, 2012-2022 ($Million)

6.5.4.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

6.5.5. France

6.5.5.1. Market Assessment and Forecast, By Technology, 2012-2022 ($Million)

6.5.5.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

6.5.6. UK

6.5.6.1. Market Assessment and Forecast, By Technology, 2012-2022 ($Million)

6.5.6.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

6.5.7. Italy

6.5.7.1. Market Assessment and Forecast, By Technology, 2012-2022 ($Million)

6.5.7.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

6.5.8. Spain

6.5.8.1. Market Assessment and Forecast, By Technology, 2012-2022 ($Million)

6.5.8.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

6.5.9. Rest of Europe

6.5.9.1. Market Assessment and Forecast, By Technology, 2012-2022 ($Million)

6.5.9.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

6.6. Asia-Pacific

6.6.1. Market Assessment and Forecast, By Country, 2012-2022 ($Million)

6.6.2. Market Assessment and Forecast, By Technology, 2012-2022 ($Million)

6.6.3. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

6.6.4. Japan

6.6.4.1. Market Assessment and Forecast, By Technology, 2012-2022 ($Million)

6.6.4.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

6.6.5. China

6.6.5.1. Market Assessment and Forecast, By Technology, 2012-2022 ($Million)

6.6.5.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

6.6.6. Australia

6.6.6.1. Market Assessment and Forecast, By Technology, 2012-2022 ($Million)

6.6.6.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

6.6.7. India

6.6.7.1. Market Assessment and Forecast, By Technology, 2012-2022 ($Million)

6.6.7.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

6.6.8. South Korea

6.6.8.1. Market Assessment and Forecast, By Technology, 2012-2022 ($Million)

6.6.8.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

6.6.9. Rest of Asia-Pacific

6.6.9.1. Market Assessment and Forecast, By Technology, 2012-2022 ($Million)

6.6.9.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

6.7. Rest of the World

6.7.1. Market Assessment and Forecast, By Country, 2012-2022 ($Million)

6.7.2. Market Assessment and Forecast, By Technology, 2012-2022 ($Million)

6.7.3. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

6.7.4. Brazil

6.7.4.1. Market Assessment and Forecast, By Technology, 2012-2022 ($Million)

6.7.4.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

6.7.5. Turkey

6.7.5.1. Market Assessment and Forecast, By Technology, 2012-2022 ($Million)

6.7.5.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

6.7.6. Saudi Arabia

6.7.6.1. Market Assessment and Forecast, By Technology, 2012-2022 ($Million)

6.7.6.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

6.7.7. South Africa

6.7.7.1. Market Assessment and Forecast, By Technology, 2012-2022 ($Million)

6.7.7.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

6.7.8. United Arab Emirates

6.7.8.1. Market Assessment and Forecast, By Technology, 2012-2022 ($Million)

6.7.8.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

6.7.9. Others

6.7.9.1. Market Assessment and Forecast, By Technology, 2012-2022 ($Million)

6.7.9.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

7. Company Profiles

7.1. Sony Corporation

7.1.1. Business Overview

7.1.2. Product Portfolio

7.1.3. Key Financials

7.1.4. Strategic Developments

7.2. Samsung Electronics Co., Ltd.

7.2.1. Business Overview

7.2.2. Product Portfolio

7.2.3. Key Financials

7.2.4. Strategic Developments

7.3. OmniVision Technologies, Inc.

7.3.1. Business Overview

7.3.2. Product Portfolio

7.3.3. Key Financials

7.3.4. Strategic Developments

7.4. Canon, Inc.

7.4.1. Business Overview

7.4.2. Product Portfolio

7.4.3. Key Financials

7.4.4. Strategic Developments

7.5. ON Semiconductor

7.5.1. Business Overview

7.5.2. Product Portfolio

7.5.3. Strategic Developments

7.6. Toshiba Corporation

7.6.1. Business Overview

7.6.2. Product Portfolio

7.6.3. Strategic Developments

7.7. Panasonic Corporation

7.7.1. Business Overview

7.7.2. Product Portfolio

7.7.3. Strategic Developments

7.8. SK Hynix

7.8.1. Business Overview

7.8.2. Product Portfolio

7.8.3. Strategic Developments

7.9. STMicroelectronics

7.9.1. Business Overview

7.9.2. Product Portfolio

7.9.3. Key Financials

7.9.4. Strategic Developments

7.10. Pixart Imaging, Inc.

7.10.1. Business Overview

7.10.2. Product Portfolio

7.10.3. Strategic Developments

List of Tables

Table 1.Global Image Sensor Market, By Technology, 2012-2022 ($Million)

Table 2.CMOS Market, By Region, 2012-2022 ($Million)

Table 3.CCD Market, By Region, 2012-2022 ($Million)

Table 4.Global Image Sensor Market, By Application, 2012-2022 ($Million)

Table 5.Automotive Market, By Region, 2012-2022 ($Million)

Table 6.Consumer Electronics Market, By Region, 2012-2022 ($Million)

Table 7.Security &Surveillance Market, By Region, 2012-2022 ($Million)

Table 8.Industrial/Defense Market, By Region, 2012-2022 ($Million)

Table 9.Medical Market, By Region, 2012-2022 ($Million)

Table 10.Other Applications Market, By Region, 2012-2022 ($Million)

Table 11.North America Image Sensor Market, By Country, 2012-2022 ($Million)

Table 12.North America Image Sensor Market, By Technology, 2012-2022 ($Million)

Table 13.North America Image Sensor Market, By Application, 2012-2022 ($Million)

Table 14.U.S. Image Sensor Market, By Technology, 2012-2022 ($Million)

Table 15.U.S. Image Sensor Market, By Application, 2012-2022 ($Million)

Table 16.Canada Image Sensor Market, By Technology, 2012-2022 ($Million)

Table 17.Canada Image Sensor Market, By Application, 2012-2022 ($Million)

Table 18.Mexico Image Sensor Market, By Technology, 2012-2022 ($Million)

Table 19.Mexico Image Sensor Market, By Application, 2012-2022 ($Million)

Table 20.Europe Image Sensor Market, By Country, 2012-2022 ($Million)

Table 21.Europe Image Sensor Market, By Technology, 2012-2022 ($Million)

Table 22.Europe Image Sensor Market, By Application, 2012-2022 ($Million)

Table 23.Germany Image Sensor Market, By Technology, 2012-2022 ($Million)

Table 24.Germany Image Sensor Market, By Application, 2012-2022 ($Million)

Table 25.France Image Sensor Market, By Technology, 2012-2022 ($Million)

Table 26.France Image Sensor Market, By Application, 2012-2022 ($Million)

Table 27.UK Image Sensor Market, By Technology, 2012-2022 ($Million)

Table 28.UK Image Sensor Market, By Application, 2012-2022 ($Million)

Table 29.Italy Image Sensor Market, By Technology, 2012-2022 ($Million)

Table 30.Italy Image Sensor Market, By Application, 2012-2022 ($Million)

Table 31.Spain Image Sensor Market, By Technology, 2012-2022 ($Million)

Table 32.Spain Image Sensor Market, By Application, 2012-2022 ($Million)

Table 33.Rest of Europe Image Sensor Market, By Technology, 2012-2022 ($Million)

Table 34.Rest of Europe Image Sensor Market, By Application, 2012-2022 ($Million)

Table 35.Asia-Pacific Image Sensor Market, By Country, 2012-2022 ($Million)

Table 36.Asia-Pacific Image Sensor Market, By Technology, 2012-2022 ($Million)

Table 37.Asia-Pacific Image Sensor Market, By Application, 2012-2022 ($Million)

Table 38.Japan Image Sensor Market, By Technology, 2012-2022 ($Million)

Table 39.Japan Image Sensor Market, By Application, 2012-2022 ($Million)

Table 40.China Image Sensor Market, By Technology, 2012-2022 ($Million)

Table 41.China Image Sensor Market, By Application, 2012-2022 ($Million)

Table 42.Australia Image Sensor Market, By Technology, 2012-2022 ($Million)

Table 43.Australia Image Sensor Market, By Application, 2012-2022 ($Million)

Table 44.India Image Sensor Market, By Technology, 2012-2022 ($Million)

Table 45.India Image Sensor Market, By Application, 2012-2022 ($Million)

Table 46.South Korea Image Sensor Market, By Technology, 2012-2022 ($Million)

Table 47.South Korea Image Sensor Market, By Application, 2012-2022 ($Million)

Table 48.Rest of Asia-Pacific Image Sensor Market, By Technology, 2012-2022 ($Million)

Table 49.Rest of Asia-Pacific Image Sensor Market, By Application, 2012-2022 ($Million)

Table 50.Rest of the World Image Sensor Market, By Country, 2012-2022 ($Million)

Table 51.Rest of the World Image Sensor Market, By Technology, 2012-2022 ($Million)

Table 52.Rest of the World Image Sensor Market, By Application, 2012-2022 ($Million)

Table 53.Brazil Image Sensor Market, By Technology, 2012-2022 ($Million)

Table 54.Brazil Image Sensor Market, By Application, 2012-2022 ($Million)

Table 55.Turkey Image Sensor Market, By Technology, 2012-2022 ($Million)

Table 56.Turkey Image Sensor Market, By Application, 2012-2022 ($Million)

Table 57.Saudi Arabia Image Sensor Market, By Technology, 2012-2022 ($Million)

Table 58.Saudi Arabia Image Sensor Market, By Application, 2012-2022 ($Million)

Table 59.South Africa Image Sensor Market, By Technology, 2012-2022 ($Million)

Table 60.South Africa Image Sensor Market, By Application, 2012-2022 ($Million)

Table 61.United Arab Emirates Image Sensor Market, By Technology, 2012-2022 ($Million)

Table 62.United Arab Emirates Image Sensor Market, By Application, 2012-2022 ($Million)

Table 63.Others Image Sensor Market, By Technology, 2012-2022 ($Million)

Table 64.Others Image Sensor Market, By Application, 2012-2022 ($Million)

Table 65.Sony Corporation: Key Strategic Developments, 2017-2017

Table 66.Samsung Electronics Co., Ltd.: Key Strategic Developments, 2017-2017

Table 67.OmniVision Technologies, Inc.: Key Strategic Developments, 2017-2017

Table 68.Canon, Inc.: Key Strategic Developments, 2017-2017

Table 69.ON Semiconductor: Key Strategic Developments, 2017-2017

Table 70.Toshiba Corporation: Key Strategic Developments, 2017-2017

Table 71.Panasonic Corporation: Key Strategic Developments, 2017-2017

Table 72.SK Hynix: Key Strategic Developments, 2017-2017

Table 73.STMicroelectronics: Key Strategic Developments, 2017-2017

Table 74.Pixart Imaging, Inc.: Key Strategic Developments, 2017-2017

List of Figures

Figure 1.Global Image Sensor Market Share, By Technology, 2017 & 2025

Figure 2.Global Image Sensor Market, By Application, 2017, ($Million)

Figure 3.Global Image Sensor Market, By Region, 2017, ($Million)

Figure 4.Sony Corporation: Net Revenues, 2017-2017 ($Million)

Figure 5.Sony Corporation: Net Revenue Share, By Segment, 2017

Figure 6.Sony Corporation: Net Revenue Share, By Geography, 2017

Figure 7.Samsung Electronics Co., Ltd.: Net Revenues, 2017-2017 ($Million)

Figure 8.Samsung Electronics Co., Ltd.: Net Revenue Share, By Segment, 2017

Figure 9.Samsung Electronics Co., Ltd.: Net Revenue Share, By Geography, 2017

Figure 10.OmniVision Technologies, Inc.: Net Revenues, 2017-2017 ($Million)

Figure 11.OmniVision Technologies, Inc.: Net Revenue Share, By Segment, 2017

Figure 12.OmniVision Technologies, Inc.: Net Revenue Share, By Geography, 2017

Figure 13.Canon, Inc.: Net Revenues, 2017-2017 ($Million)

Figure 14.Canon, Inc.: Net Revenue Share, By Segment, 2017

Figure 15.Canon, Inc.: Net Revenue Share, By Geography, 2017

Figure 16.STMicroelectronics: Net Revenues, 2017-2017 ($Million)

Figure 17.STMicroelectronics: Net Revenue Share, By Segment, 2017

Figure 18.STMicroelectronics: Net Revenue Share, By Geography, 2017

Research Methodology

We use both primary as well as secondary research for our market surveys, estimates and for developing forecast. Our research process commence by analyzing the problem which enable us to design the scope for our research study. Our research process is uniquely designed with enough flexibility to adjust according to changing nature of products and markets, while retaining core element to ensure reliability and accuracy in research findings. We understand both macro and micro-economic factors to evaluate and forecast different market segments.

Data Mining

Data is extensively collected through various secondary sources such as annual reports, investor presentations, SEC filings, and other corporate publications. We also refer trade magazines, technical journals, paid databases such as Factiva and Bloomberg, industry trade journals, scientific journals, and social media data to understand market dynamics and industry trends. Further, we also conduct primary research to understand market drivers, restraints, opportunities, challenges, and competitive scenario to build our analysis.

Data Collection Matrix

|

Data Collection Matrix |

Supply Side |

Demand Side |

|

Primary Data Sources |

|

|

|

Secondary Data Sources |

|

|

Market Modeling and Forecasting

We use epidemiology and capital equipment-based models to forecast market size of different segments at country and regional level.

- Epidemiology-based Forecasting Model: This method uses epidemiology data gathered through various publications and from physicians to estimate population of patients, flow of treatment of individual disease and therapies. The data collected through this method includes statics on incidence of disease, population suffering from disease, and treatment population. This method is used to understand:

- Number of patients for particular device or medical procedure and

- Repeated use of particular device depending on health and condition of patient

- Capital-based Forecasting Model: This method of forecasting is based on number of replacements, installed-based and new sales of capital equipment used in various healthcare and diagnostic centers. These three parameters are calculated and forecast is developed. Installation base is calculated as average number of units per facility; while sales for particular year is calculated from number of new and replace units. Secondary data is collected through various supply chain intermediaries and opinion leaders to arrive at installation and sales rate. These techniques help our analysts in validating market and developed market estimates and forecast.

We do forecast on basis of several parameters such as market drivers, market opportunities, industry trends government regulations, raw materials supply and trade dynamics to ensure relevance of forecast with market scenario. With increasing need to granulized information, we used bottom-up methodology for forecasting where we evaluate each regional segment differently and combined all forecast to develop final market forecast.

Data Validation

We believe primary research is a very important tool in analyzing and forecasting different markets. In order to make sure accuracy of our findings, our team conducts primary interviews at every stage of research to gain deep insights into current business environment and future trends and key developments in market. This includes use of various methods such as telephonic interviews, focus groups, face to face interviews and questionnaires to validate our research from all aspects. We validate our data through primary research from key industry leaders such as CEO, product managers, marketing managers, suppliers, distributors, and consumers are frequently interviewed. These interviews provide valuable insights which help us to have better market understanding besides validating our estimates and forecast.

Data Triangulation

Industry Analysis

|

Qualitative Data |

Quantitative Data (2017-2025) |

|

|