.png)

Zeolite Molecular Sieve Market By Application - Global Industry Analysis and Forecast to 2023

Published On : February 2018 Pages : 80 Category: Organic Chemicals Report Code : CM02616

SEGMENTS & REGIONS:

- Regions: North America, Europe, Asia- Pacific, Latin America, Middle East & Africa

Industry Trend Analysis

In 2017, the global zeolite molecular sieve market was evaluated around USD billion and is expected to reach approximately USD billion by 2023 while registering itself at a compound annual growth rate (CAGR) of % over the forecast period owing to its rising demand in producing catalysts and detergent. Additionally, it is also widely utilized as an absorbent owing to its sieve-like composition. These sieves are utilized for adsorption and separation across several industries involving water treatment, detergents, and oil & gas. Rising demand for detergents owing to growing hygiene awareness levels amongst consumers is projected to boost the demand as a builder in powder and liquid detergents. Also, the growth of oil & gas industries along with rising demand for catalysts which render higher output is anticipated to boost the zeolite molecular sieve market during the next few years. Moreover, rising water treatment processes for purification of water as well as treating wastewater is expected to drive demand for the product as adsorbents. Though, the existence of metals, enzymes, and other chemical substances as an alternative to zeolite catalysts is projected to hinder the growth of the global market. The appearance of silver infused sieves as an antimicrobial is projected to initiate new opportunities for industry growth during the forecast years.

Application Outlook and Trend Analysis

In 2017, detergents were the leading application section of global zeolite molecular sieve market, with wide utilize as binders in detergents. Rising detergents demand owing to rising customer awareness concerning hygiene is anticipated to consequently augment the growth of the global industry. Catalysts are expected to be the highest growing section within the global zeolite molecular sieve market due to the growth of gas & oil industries. Increasing high-performance catalysts’ demand which renders higher output is anticipated to drive industry expansion. Other applications involve its utilization as a separator in the gas industry and adsorbent for the treatment of wastewater. The expansion of the wastewater treatment and gas industries is anticipated to drive industry demand during the forecast years.

Regional Outlook and Trend Analysis

In 2017, European zeolite molecular sieve industry ruled global demand, a drift that is expected to continue during the forecast years. The regulatory tendency towards the limit of greenhouse gas emissions along with a tough manufacturing base of detergents and refrigerants in France, Germany, Belgium, and Netherlands is anticipated to boost the growth. During 2009, the European Commission sanctioned a directive named Renewable Energy Directive (RED), which has made % of EU energy production mandatory from biomass by the end of 2021. This strategy is anticipated to augment the manufacturing of bio-based chemicals. Over the forecast years, Asia-Pacific is projected to experience the fastest expansion within the industry on account of increasing demand for catalysts and detergents. Growing focus on ecological protection by several governments has ensued in a rising use of zeolites for purifying gas streams and water purification. Growing infrastructure spending in nations including India and China is likely to improve the growth of the market due to rising use in manufacturing lightweight construction material and being a significant ingredient in manufacturing asphalt concrete blend. In 2017, Detergents were the major application section in the Asia Pacific regional zeolite molecular sieve industry reporting for approximately % of market volume. The Latin American region is expected to experience above normal growth owing to fast industrialization. Catalysts were the major application section of the Latin American regional zeolite molecular sieve market reporting for around % of the market revenue.

Competitive Outlook and Trend Analysis

In 2017, Tosoh Corporation, Arkema, BASF, UOP, Grace Catalysts Technologies, Zeox Corporation, Chemiewerk Bad Köstritz and Union Showa K K ruled the global zeolite molecular sieve market. Union Showa K K, Chemiewerk Bad Köstritz, and Arkema are incorporated players, occupied in the manufacturing of at least one main feedstock which is captively used for production sieves.

The global zeolite molecular sieve market is segmented as follows –

By Application

- Detergents

- Catalysts

- Others

By Region

- North America

- U.S

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- Japan

- China

- Australia

- India

- South Korea

- Rest of Asia Pacific

- Rest of the World

- Brazil

- South Africa

- Saudi Arabia

- United Arab Emirates

- Others

Some of the key questions answered by the report are:

· What was the market size in 2017 and forecast from 2017 to 2023?

· What will be the industry market growth from 2017 to 2023?

· What are the major drivers, restraints, opportunities, challenges, and industry trends and their impact on the market forecast?

· What are the major segments leading the market growth and why?

· Which are the leading players in the market and what are the major strategies adopted by them to sustain the market competition?

Market Classification

· Zeolite Molecular Sieve Market, By Application, Estimates and Forecast, 2014-2023 ($Million)

· Detergents

· Catalysts

· Other Applications

· Zeolite Molecular Sieve Market, By Region, Estimates and Forecast, 2014-2023 ($Million)

o North America

§ North America Zeolite Molecular Sieve Market, By Country

§ North America Zeolite Molecular Sieve Market, By Application

o U.S. Zeolite Molecular Sieve Market, By Application

o Canada Zeolite Molecular Sieve Market, By Application

o Mexico Zeolite Molecular Sieve Market, By Application

o Europe

§ Europe Zeolite Molecular Sieve Market, By Country

§ Europe Zeolite Molecular Sieve Market, By Application

o Germany Zeolite Molecular Sieve Market, By Application

o France Zeolite Molecular Sieve Market, By Application

o UK Zeolite Molecular Sieve Market, By Application

o Italy Zeolite Molecular Sieve Market, By Application

o Spain Zeolite Molecular Sieve Market, By Application

o Rest of Europe Zeolite Molecular Sieve Market, By Application

o Asia-Pacific

§ Asia-Pacific Zeolite Molecular Sieve Market, By Country

§ Asia-Pacific Zeolite Molecular Sieve Market, By Application

o Japan Zeolite Molecular Sieve Market, By Application

o Australia Zeolite Molecular Sieve Market, By Application

o India Zeolite Molecular Sieve Market, By Application

o South Korea Zeolite Molecular Sieve Market, By Application

o Rest of Asia-Pacific Zeolite Molecular Sieve Market, By Application

o Rest of the World

§ Rest of the World Zeolite Molecular Sieve Market, By Country

§ Rest of the World Zeolite Molecular Sieve Market, By Application

o Brazil Zeolite Molecular Sieve Market, By Application

o South Africa Zeolite Molecular Sieve Market, By Application

o Saudi Arabia Zeolite Molecular Sieve Market, By Application

o Turkey Zeolite Molecular Sieve Market, By Application

o United Arab Emirates Zeolite Molecular Sieve Market, By Application

o Others Zeolite Molecular Sieve Market, By Application

Table of Contents

1. Introduction

1.1. Report Description

1.2. Research Methodology

1.2.1. Secondary Research

1.2.2. Primary Research

2. Executive Summary

2.1. Key Highlights

3. Market Overview

3.1. Introduction

3.1.1. Market Definition

3.1.2. Market Segmentation

3.2. Market Dynamics

3.2.1. Drivers

3.2.1.1. Growing Demand for Detergents

3.2.1.2. Increasing Refining Output

3.2.1.3. Rising Demand for Adsorbents

3.2.2. Restraints

3.2.2.1. Threat of Substitution as a Catalyst

3.2.3. Opportunities

3.2.3.1. Emerging Markets to Offer Lucrative Growth Opportunities

4. Zeolite Molecular Sieve Market, By Application

4.1. Introduction

4.2. Global Zeolite Molecular Sieve Sales, Revenue and Market Share by Application (2017-2017)

4.2.1. Global Zeolite Molecular Sieve Sales and Sales Share by Application (2017-2017)

4.2.2. Global Zeolite Molecular Sieve Revenue and Revenue Share by Application (2017-2017)

4.3. Zeolite Molecular Sieve Market Assessment and Forecast, By Application, 2017-2023

4.4. Detergents

4.4.1. Market Assessment and Forecast, By Region, 2017-2023($Million)

4.5. Catalysts

4.5.1. Market Assessment and Forecast, By Region, 2017-2023($Million)

4.6. Other Applications

4.6.1. Market Assessment and Forecast, By Region, 2017-2023($Million)

5. Zeolite Molecular Sieve Market , By Region

5.1. Introduction

5.2. Zeolite Molecular Sieve Market Assessment and Forecast, By Region, 2017-2023($Million)

5.3. Global Zeolite Molecular Sieve Sales, Revenue and Market Share by Regions

5.3.1. Global Zeolite Molecular Sieve Sales by Regions (2017-2017)

5.3.2. Global Zeolite Molecular Sieve Revenue by Regions (2017-2017)

5.4. North America

5.4.1. North America Zeolite Molecular Sieve Sales and Growth Rate (2017-2017)

5.4.2. Market Assessment and Forecast, By Country, 2017-2023($Million)

5.4.3. Market Assessment and Forecast, By Application, 2017-2023($Million)

5.4.4. U.S.

5.4.4.1. Market Assessment and Forecast, By Application, 2017-2023($Million)

5.4.5. Canada

5.4.5.1. Market Assessment and Forecast, By Application, 2017-2023($Million)

5.4.6. Mexico

5.4.6.1. Market Assessment and Forecast, By Application, 2017-2023($Million)

5.5. Europe

5.5.1. Europe Zeolite Molecular Sieve Sales and Growth Rate (2017-2017)

5.5.2. Market Assessment and Forecast, By Country, 2017-2023($Million)

5.5.3. Market Assessment and Forecast, By Application, 2017-2023($Million)

5.5.4. Germany

5.5.4.1. Market Assessment and Forecast, By Application, 2017-2023($Million)

5.5.5. France

5.5.5.1. Market Assessment and Forecast, By Application, 2017-2023($Million)

5.5.6. UK

5.5.6.1. Market Assessment and Forecast, By Application, 2017-2023($Million)

5.5.7. Italy

5.5.7.1. Market Assessment and Forecast, By Application, 2017-2023($Million)

5.5.8. Spain

5.5.8.1. Market Assessment and Forecast, By Application, 2017-2023($Million)

5.5.9. Rest of Europe

5.5.9.1. Market Assessment and Forecast, By Application, 2017-2023($Million)

5.6. Asia-Pacific

5.6.1. Asia-Pacific Zeolite Molecular Sieve Sales and Growth Rate (2017-2017)

5.6.2. Market Assessment and Forecast, By Country, 2017-2023($Million)

5.6.3. Market Assessment and Forecast, By Application, 2017-2023($Million)

5.6.4. Japan

5.6.4.1. Market Assessment and Forecast, By Application, 2017-2023($Million)

5.6.5. China

5.6.5.1. Market Assessment and Forecast, By Application, 2017-2023($Million)

5.6.6. Australia

5.6.6.1. Market Assessment and Forecast, By Application, 2017-2023($Million)

5.6.7. India

5.6.7.1. Market Assessment and Forecast, By Application, 2017-2023($Million)

5.6.8. South Korea

5.6.8.1. Market Assessment and Forecast, By Application, 2017-2023($Million)

5.6.9. Rest of Asia-Pacific

5.6.9.1. Market Assessment and Forecast, By Application, 2017-2023($Million)

5.7. Rest of the World

5.7.1. Rest of the World Zeolite Molecular Sieve Sales and Growth Rate (2017-2017)

5.7.2. Market Assessment and Forecast, By Country, 2017-2023($Million)

5.7.3. Market Assessment and Forecast, By Application, 2017-2023($Million)

5.7.4. Brazil

5.7.4.1. Market Assessment and Forecast, By Application, 2017-2023($Million)

5.7.5. Turkey

5.7.5.1. Market Assessment and Forecast, By Application, 2017-2023($Million)

5.7.6. Saudi Arabia

5.7.6.1. Market Assessment and Forecast, By Application, 2017-2023($Million)

5.7.7. South Africa

5.7.7.1. Market Assessment and Forecast, By Application, 2017-2023($Million)

5.7.8. United Arab Emirates

5.7.8.1. Market Assessment and Forecast, By Application, 2017-2023($Million)

5.7.9. Others

5.7.9.1. Market Assessment and Forecast, By Application, 2017-2023($Million)

6. Company Profiles

6.1. Tosoh Corporation

6.1.1. Business Overview

6.1.2. Product Portfolio

6.1.3. Strategic Developments

6.1.4. Zeolite Molecular Sieve Sales, Revenue and Market Share

6.2. BASF SE

6.2.1. Business Overview

6.2.2. Product Portfolio

6.2.3. Strategic Developments

6.2.4. Zeolite Molecular Sieve Sales, Revenue and Market Share

6.3. Arkema Group

6.3.1. Business Overview

6.3.2. Product Portfolio

6.3.3. Strategic Developments

6.3.4. Zeolite Molecular Sieve Sales, Revenue and Market Share

6.4. Interra Global Corporation

6.4.1. Business Overview

6.4.2. Product Portfolio

6.4.3. Strategic Developments

6.4.4. Zeolite Molecular Sieve Sales, Revenue and Market Share

6.5. UOP LLC

6.5.1. Business Overview

6.5.2. Product Portfolio

6.5.3. Strategic Developments

6.5.4. Zeolite Molecular Sieve Sales, Revenue and Market Share

6.6. Zeochem AG

6.6.1. Business Overview

6.6.2. Product Portfolio

6.6.3. Strategic Developments

6.6.4. Zeolite Molecular Sieve Sales, Revenue and Market Share

6.7. Grace Catalysts Technologies

6.7.1. Business Overview

6.7.2. Product Portfolio

6.7.3. Strategic Developments

6.7.4. Zeolite Molecular Sieve Sales, Revenue and Market Share

6.8. Chemiewerk Bad Köstritz

6.8.1. Business Overview

6.8.2. Product Portfolio

6.8.3. Strategic Developments

6.8.4. Zeolite Molecular Sieve Sales, Revenue and Market Share

6.9. Tricat Group

6.9.1. Business Overview

6.9.2. Product Portfolio

6.9.3. Strategic Developments

6.9.4. Zeolite Molecular Sieve Sales, Revenue and Market Share

6.10. KNT Group

6.10.1. Business Overview

6.10.2. Product Portfolio

6.10.3. Strategic Developments

6.10.4. Zeolite Molecular Sieve Sales, Revenue and Market Share

6.11. Zeox Corporation

6.11.1. Business Overview

6.11.2. Product Portfolio

6.11.3. Strategic Developments

6.11.4. Zeolite Molecular Sieve Sales, Revenue and Market Share

7. Global Zeolite Molecular Sieve Market Competition, by Manufacturer

7.1. Global Zeolite Molecular Sieve Sales and Market Share by Manufacturer (2017-2017)

7.2. Global Zeolite Molecular Sieve Revenue and Market Share by Manufacturer (2017-2017)

7.3. Top 5 Zeolite Molecular Sieve Manufacturer Market Share

7.4. Market Competition Trend

List of Tables and Figures

*You can glance through the list of Tables and Figures when you view the sample copy of Zeolite Molecular Sieve Market.

Research Methodology

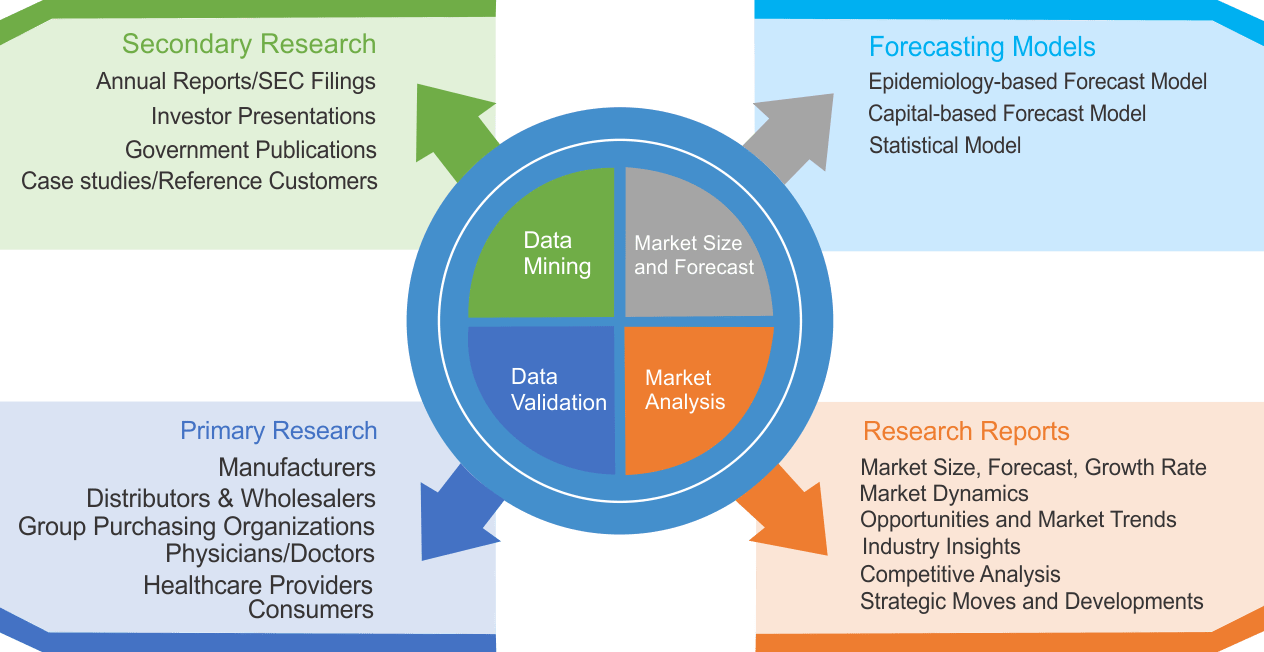

We use both primary as well as secondary research for our market surveys, estimates and for developing forecast. Our research process commence by analyzing the problem which enable us to design the scope for our research study. Our research process is uniquely designed with enough flexibility to adjust according to changing nature of products and markets, while retaining core element to ensure reliability and accuracy in research findings. We understand both macro and micro-economic factors to evaluate and forecast different market segments.

Data Mining

Data is extensively collected through various secondary sources such as annual reports, investor presentations, SEC filings, and other corporate publications. We also refer trade magazines, technical journals, paid databases such as Factiva and Bloomberg, industry trade journals, scientific journals, and social media data to understand market dynamics and industry trends. Further, we also conduct primary research to understand market drivers, restraints, opportunities, challenges, and competitive scenario to build our analysis.

Data Collection Matrix

|

Data Collection Matrix |

Supply Side |

Demand Side |

|

Primary Data Sources |

|

|

|

Secondary Data Sources |

|

|

Market Modeling and Forecasting

We use epidemiology and capital equipment-based models to forecast market size of different segments at country and regional level.

- Epidemiology-based Forecasting Model: This method uses epidemiology data gathered through various publications and from physicians to estimate population of patients, flow of treatment of individual disease and therapies. The data collected through this method includes statics on incidence of disease, population suffering from disease, and treatment population. This method is used to understand:

- Number of patients for particular device or medical procedure and

- Repeated use of particular device depending on health and condition of patient

- Capital-based Forecasting Model: This method of forecasting is based on number of replacements, installed-based and new sales of capital equipment used in various healthcare and diagnostic centers. These three parameters are calculated and forecast is developed. Installation base is calculated as average number of units per facility; while sales for particular year is calculated from number of new and replace units. Secondary data is collected through various supply chain intermediaries and opinion leaders to arrive at installation and sales rate. These techniques help our analysts in validating market and developed market estimates and forecast.

We do forecast on basis of several parameters such as market drivers, market opportunities, industry trends government regulations, raw materials supply and trade dynamics to ensure relevance of forecast with market scenario. With increasing need to granulized information, we used bottom-up methodology for forecasting where we evaluate each regional segment differently and combined all forecast to develop final market forecast.

Data Validation

We believe primary research is a very important tool in analyzing and forecasting different markets. In order to make sure accuracy of our findings, our team conducts primary interviews at every stage of research to gain deep insights into current business environment and future trends and key developments in market. This includes use of various methods such as telephonic interviews, focus groups, face to face interviews and questionnaires to validate our research from all aspects. We validate our data through primary research from key industry leaders such as CEO, product managers, marketing managers, suppliers, distributors, and consumers are frequently interviewed. These interviews provide valuable insights which help us to have better market understanding besides validating our estimates and forecast.

Data Triangulation

Industry Analysis

|

Qualitative Data |

Quantitative Data (2017-2025) |

|

|