.png)

Thermoplastic Elastomers (TPE) Market By Product - Global Industry Analysis and Forecast to 2023

Published On : February 2018 Pages : 160 Category: Plastics, Polymers & Resins Report Code : CM02612

SEGMENTS & REGIONS:

- Regions: North America, Europe, Asia- Pacific, Latin America, Middle East & Africa

Thermoplastic Elastomers (TPE) Market by Product- GLOBAL INDUSTRY ANALYSIS AND FORECAST TO 2023

Industry Outlook and Trend Analysis

The Thermoplastic Elastomers (TPE) Market was worth USD billion in the year of 2017 and is expected to reach approximately USD billion by 2023, while registering itself at a compound annual growth rate (CAGR) of % during the forecast period. Expanding usage crosswise over different applications, for example, construction, footwear, consumer goods, and electronics has been assisting in the worldwide market development in the course of couple of years. Expanding requirement in the manufacturing of automotive components is anticipated to be a main consideration driving the worldwide business development over the estimate time frame. Administrative intervention by environmental agencies focused on reduction of carbon emanation through an expansion in fuel productivity has constrained major automotive OEMs to consolidate plastics as an alternative to metals and composites in automotive parts. Expanding consumer inclination for superior and lightweight passenger cars has been driving plastics advancement in the manufacturing of automotive. These aspects have prompted expanded thermoplastics usage in the previously mentioned application. Thermoplastic elastomers provide better chemical and physical properties in comparison to thermoset plastics, hence picking up inclination on the basis of application. High substitution rate of TPU and TPO as an option to ethylene propylene diene monomer (EPDM) in construction materials is foreseen to supplement the demand of worldwide industry over the conjecture time frame. TPEs are eco-friendly and extraordinary thermoplastics that are recyclable as well as be re-formed and re-molded, hence disposing of wastage broadly. These offer different benefits regarding physical qualities and attributes, for example, providing soft-touch to materials, oxidation, UV, and resistance to chemicals.

Product Outlook and Trend Analysis

Essential items investigated for worldwide TPE market incorporates TPV, TPO, SBC, TPU, and COPES for example, melt processable rubber and thermoplastic polyamides. Also, every item has been sectioned on the basis of their particular applications. In 2017 SBC was the biggest expended product with its request evaluated at 1,889.2 kilo tons. In 2017 SBS is a noteworthy SBC item devoured which represented more than 70 percent of the item volume. Expanding requirement for SIS especially in India and China is anticipated to drive the product section development throughout the following years. Expanding usage in automotive in the fascia systems and hood applications is foreseen to be a main consideration driving the worldwide TPV consumption. TPU is gaining popularity in construction applications attributable to its acoustic and thermal insulation elements. Developing significance of energy proficiency in buildings and resulting administrative approaches focused at zero energy buildings are anticipated to boost TPU requirement in the construction sector throughout the following years.

Regional Outlook and Trend Analysis

In 2017 Asia Pacific thermoplastic elastomers market rose as the biggest consumer and represented more than 40 percent of the total volume. In 2017 Japan, China, and India are significant purchasers in APAC and represented more than 85 percent of the regional volume. High automotive and construction industry development in India and China alongside expanding production of electronic and footwear merchandise in Southeast Asia is foreseen to boost the TPE demand in APAC over the estimate time frame. North America is defined by significant R&D by domestic organizations focused at product development and expanded scope of application. Organized administrative policies relating to application particular plastic disposal and usage is anticipated to significantly affect the regional market development. Expanding car creation in Mexico and United States alongside consumer and construction industries development in Mexico is foreseen to drive North America TPE requirement over the estimate time frame.

Competitive Insights

Some of the leading players in this market are Kraton, LyondellBasell, Sinopec and Dow Chemical Company. Leading organizations are moving their production capacities to high development potential markets, for example, Southeast Asia, China, India, and Brazil. The shift in manufacturing can be credited to high TPE requirement in previously mentioned districts combined with positive production conditions, for example, simple raw material obtainment and low operational and labor expenses. Major manufacturers, for example, Zeon and Muller Kunststoffe have begun expansion of capacities in Japan and China individually. The existence of a large number of small scale domestic producers in these areas is anticipated to fortify rivalry among organizations. Mitsubishi is currently putting resources into R&D to enhance production forms by wiping out harmful ingredients (phosgene) and creating plant-based bio-based thermoplastic elastomers.

The global Thermoplastic Elastomers Market is segmented as follows-

By Product:

- Thermoplastic Polyolefins (TPO)

- Copolymer Esters (COPE)

- Styrene Block Copolymer (SBC)

- Styrene Isoprene Styrene (SIS)

- Styrene Butadiene Styrene (SBS)

- Hydrogenated Styrene Block Copolymers (HSBC)

- Thermoplastic Vulcanizates (TPV)

- Thermoplastic Polyurethanes (TPU)

By Region

- North America

- U.S

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- Japan

- China

- Australia

- India

- South Korea

- Rest of Asia Pacific

- Rest of the World

- Brazil

- South Africa

- Saudi Arabia

- United Arab Emirates

- Others

Some of the key questions answered by the report are:

- What was the market size in 2017 and forecast from 2017 to 2023?

- What will be the industry market growth from 2017 to 2023?

- What are the major drivers, restraints, opportunities, challenges, and industry trends and their impact on the market forecast?

- What are the major segments leading the market growth and why?

- Which are the leading players in the market and what are the major strategies adopted by them to sustain the market competition?

Market Classification

· Thermoplastic Elastomers (TPE) Market, By Product, Estimates and Forecast, 2014-2023 ($Million)

· Styrene Block Copolymer (SBC)

o Styrene Butadiene Styrene (SBS)

o Styrene Isoprene Styrene (SIS)

o Hydrogenated Styrene Block Copolymers (HSBC)

· Thermoplastic Polyurethanes (TPU)

· Thermoplastic Polyolefins (TPO)

· Thermoplastic Vulcanizates (TPV)

· Copolymer Esters (COPE)

· Other TPE

· Thermoplastic Elastomers (TPE) Market, By Region, Estimates and Forecast, 2014-2023 ($Million)

o North America

§ North America Thermoplastic Elastomers (TPE) Market, By Country

§ North America Thermoplastic Elastomers (TPE) Market, By Product

o U.S. Thermoplastic Elastomers (TPE) Market, By Product

o Canada Thermoplastic Elastomers (TPE) Market, By Product

o Mexico Thermoplastic Elastomers (TPE) Market, By Product

o Europe

§ Europe Thermoplastic Elastomers (TPE) Market, By Country

§ Europe Thermoplastic Elastomers (TPE) Market, By Product

o Germany Thermoplastic Elastomers (TPE) Market, By Product

o France Thermoplastic Elastomers (TPE) Market, By Product

o UK Thermoplastic Elastomers (TPE) Market, By Product

o Italy Thermoplastic Elastomers (TPE) Market, By Product

o Spain Thermoplastic Elastomers (TPE) Market, By Product

o Rest of Europe Thermoplastic Elastomers (TPE) Market, By Product

o Asia-Pacific

§ Asia-Pacific Thermoplastic Elastomers (TPE) Market, By Country

§ Asia-Pacific Thermoplastic Elastomers (TPE) Market, By Product

o Japan Thermoplastic Elastomers (TPE) Market, By Product

o Australia Thermoplastic Elastomers (TPE) Market, By Product

o India Thermoplastic Elastomers (TPE) Market, By Product

o South Korea Thermoplastic Elastomers (TPE) Market, By Product

o Rest of Asia-Pacific Thermoplastic Elastomers (TPE) Market, By Product

o Rest of the World

§ Rest of the World Thermoplastic Elastomers (TPE) Market, By Country

§ Rest of the World Thermoplastic Elastomers (TPE) Market, By Product

o Brazil Thermoplastic Elastomers (TPE) Market, By Product

o South Africa Thermoplastic Elastomers (TPE) Market, By Product

o Saudi Arabia Thermoplastic Elastomers (TPE) Market, By Product

o Turkey Thermoplastic Elastomers (TPE) Market, By Product

o United Arab Emirates Thermoplastic Elastomers (TPE) Market, By Product

o Others Thermoplastic Elastomers (TPE) Market, By Product

Table of Contents

1. Introduction

1.1. Report Description

1.2. Research Methodology

1.2.1. Secondary Research

1.2.2. Primary Research

2. Executive Summary

2.1. Key Highlights

3. Market Overview

3.1. Introduction

3.1.1. Market Definition

3.1.2. Market Segmentation

3.2. Market Dynamics

3.2.1. Drivers

3.2.1.1. Thermoplastic Elastomers Substituting Thermosets

3.2.2. Restraints

3.2.2.1. Volatile Raw Material Prices

3.2.3. Opportunities

3.2.3.1. Emerging Markets to Offer Lucrative Growth Opportunities

4. Thermoplastic Elastomers (TPE) Market, By Product

4.1. Introduction

4.2. Global Thermoplastic Elastomers (TPE) Sales, Revenue and Market Share by Product (2017-2017)

4.2.1. Global Thermoplastic Elastomers (TPE) Sales and Sales Share by Product (2017-2017)

4.2.2. Global Thermoplastic Elastomers (TPE) Revenue and Revenue Share by Product (2017-2017)

4.3. Thermoplastic Elastomers (TPE) Market Assessment and Forecast, By Product, 2017-2023

4.4. Styrene Block Copolymer (SBC)

4.4.1. Market Assessment and Forecast, By Type, 2017-2023 ($Million)

4.4.2. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

4.4.3. Styrene Butadiene Styrene (SBS)

4.4.3.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

4.4.4. Styrene Isoprene Styrene (SIS)

4.4.4.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

4.4.5. Hydrogenated Styrene Block Copolymers (HSBC)

4.4.5.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

4.5. Thermoplastic Polyurethanes (TPU)

4.5.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

4.6. Thermoplastic Polyolefins (TPO)

4.6.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

4.7. Thermoplastic Vulcanizates (TPV)

4.7.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

4.8. Copolymer Esters (COPE)

4.8.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

4.9. Other TPE

4.9.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

5. Thermoplastic Elastomers (TPE) Market, By Region

5.1. Introduction

5.2. Thermoplastic Elastomers (TPE) Market Assessment and Forecast, By Region, 2017-2023 ($Million)

5.3. Global Thermoplastic Elastomers (TPE) Sales, Revenue and Market Share by Regions

5.3.1. Global Thermoplastic Elastomers (TPE) Sales by Regions (2017-2017)

5.3.2. Global Thermoplastic Elastomers (TPE) Revenue by Regions (2017-2017)

5.4. North America

5.4.1. North America Thermoplastic Elastomers (TPE) Sales and Growth Rate (2017-2017)

5.4.2. Market Assessment and Forecast, By Country, 2017-2023 ($Million)

5.4.3. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

5.4.4. U.S.

5.4.4.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

5.4.5. Canada

5.4.5.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

5.4.6. Mexico

5.4.6.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

5.5. Europe

5.5.1. Europe Thermoplastic Elastomers (TPE) Sales and Growth Rate (2017-2017)

5.5.2. Market Assessment and Forecast, By Country, 2017-2023 ($Million)

5.5.3. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

5.5.4. Germany

5.5.4.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

5.5.5. France

5.5.5.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

5.5.6. UK

5.5.6.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

5.5.7. Italy

5.5.7.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

5.5.8. Spain

5.5.8.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

5.5.9. Rest of Europe

5.5.9.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

5.6. Asia-Pacific

5.6.1. Asia-Pacific Thermoplastic Elastomers (TPE) Sales and Growth Rate (2017-2017)

5.6.2. Market Assessment and Forecast, By Country, 2017-2023 ($Million)

5.6.3. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

5.6.4. Japan

5.6.4.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

5.6.5. China

5.6.5.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

5.6.6. Australia

5.6.6.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

5.6.7. India

5.6.7.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

5.6.8. South Korea

5.6.8.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

5.6.9. Rest of Asia-Pacific

5.6.9.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

5.7. Rest of the World

5.7.1. Rest of the World Thermoplastic Elastomers (TPE) Sales and Growth Rate (2017-2017)

5.7.2. Market Assessment and Forecast, By Country, 2017-2023 ($Million)

5.7.3. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

5.7.4. Brazil

5.7.4.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

5.7.5. Turkey

5.7.5.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

5.7.6. Saudi Arabia

5.7.6.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

5.7.7. South Africa

5.7.7.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

5.7.8. United Arab Emirates

5.7.8.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

5.7.9. Others

5.7.9.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

6. Company Profiles

6.1. Advanced Elastomer Systems L.P.

6.1.1. Business Overview

6.1.2. Product Portfolio

6.1.3. Strategic Developments

6.1.4. Thermoplastic Elastomers (TPE) Sales, Revenue and Market Share

6.2. Arkema S.A.

6.2.1. Business Overview

6.2.2. Product Portfolio

6.2.3. Strategic Developments

6.2.4. Thermoplastic Elastomers (TPE)Sales, Revenue and Market Share

6.3. BASF

6.3.1. Business Overview

6.3.2. Product Portfolio

6.3.3. Strategic Developments

6.3.4. Thermoplastic Elastomers (TPE) Sales, Revenue and Market Share

6.4. Bayer Material Science

6.4.1. Business Overview

6.4.2. Product Portfolio

6.4.3. Strategic Developments

6.4.4. Thermoplastic Elastomers (TPE) Sales, Revenue and Market Share

6.5. China Petroleum & Chemical Corporation

6.5.1. Business Overview

6.5.2. Product Portfolio

6.5.3. Strategic Developments

6.5.4. Thermoplastic Elastomers (TPE)Sales, Revenue and Market Share

6.6. Dynasol Elastomers LLC

6.6.1. Business Overview

6.6.2. Product Portfolio

6.6.3. Strategic Developments

6.6.4. Thermoplastic Elastomers (TPE) Sales, Revenue and Market Share

6.7. EMS group

6.7.1. Business Overview

6.7.2. Product Portfolio

6.7.3. Strategic Developments

6.7.4. Thermoplastic Elastomers (TPE) Sales, Revenue and Market Share

6.8. Evonik Industries

6.8.1. Business Overview

6.8.2. Product Portfolio

6.8.3. Strategic Developments

6.8.4. Thermoplastic Elastomers (TPE) Sales, Revenue and Market Share

6.9. Huntsman Corporation

6.9.1. Business Overview

6.9.2. Product Portfolio

6.9.3. Strategic Developments

6.9.4. Thermoplastic Elastomers (TPE) Sales, Revenue and Market Share

6.10. Kraton Polymers LLC

6.10.1. Business Overview

6.10.2. Product Portfolio

6.10.3. Strategic Developments

6.10.4. Thermoplastic Elastomers (TPE)Sales, Revenue and Market Share

6.11. LG Chemicals

6.11.1. Business Overview

6.11.2. Product Portfolio

6.11.3. Strategic Developments

6.11.4. Thermoplastic Elastomers (TPE) Sales, Revenue and Market Share

7. Global Thermoplastic Elastomers (TPE) Market Competition, by Manufacturer

7.1. Global Thermoplastic Elastomers (TPE) Sales and Market Share by Manufacturer (2017-2017)

7.2. Global Thermoplastic Elastomers (TPE) Revenue and Market Share by Manufacturer (2017-2017)

7.3. Top 5 Thermoplastic Elastomers (TPE) Manufacturer Market Share

7.4. Market Competition Trend

List of Tables and Figures

*You can glance through the list of Tables and Figures when you view the sample copy of Thermoplastic Elastomers (TPE) Market.

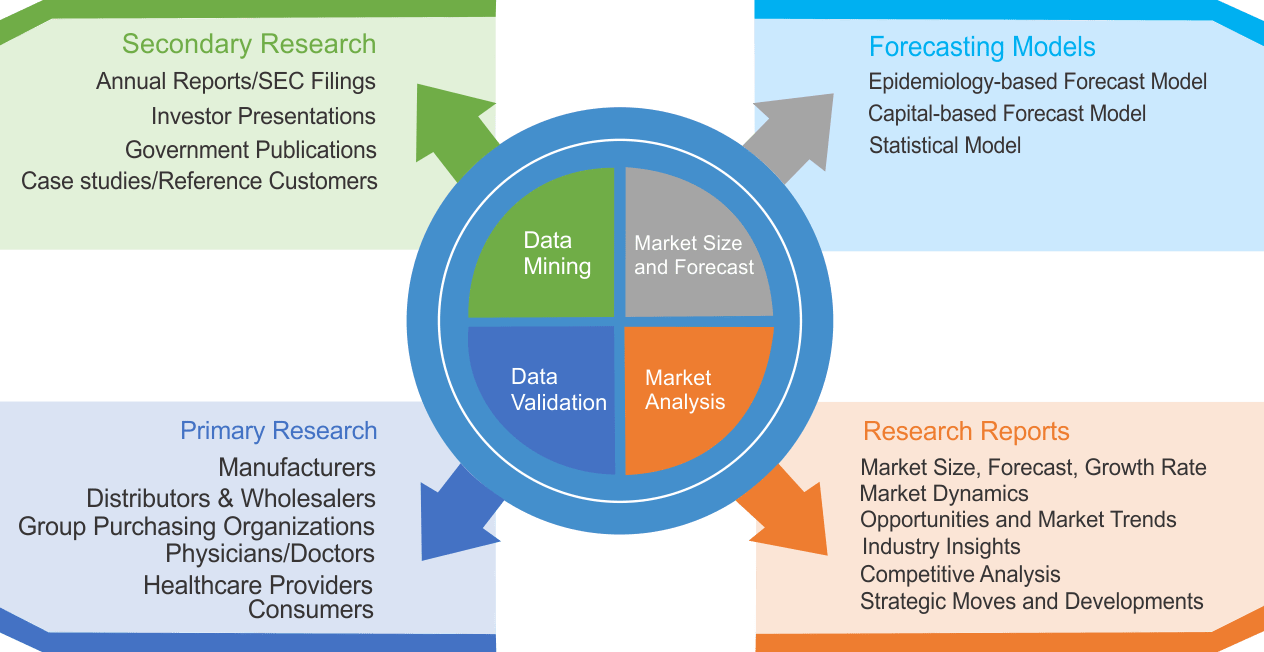

Research Methodology

We use both primary as well as secondary research for our market surveys, estimates and for developing forecast. Our research process commence by analyzing the problem which enable us to design the scope for our research study. Our research process is uniquely designed with enough flexibility to adjust according to changing nature of products and markets, while retaining core element to ensure reliability and accuracy in research findings. We understand both macro and micro-economic factors to evaluate and forecast different market segments.

Data Mining

Data is extensively collected through various secondary sources such as annual reports, investor presentations, SEC filings, and other corporate publications. We also refer trade magazines, technical journals, paid databases such as Factiva and Bloomberg, industry trade journals, scientific journals, and social media data to understand market dynamics and industry trends. Further, we also conduct primary research to understand market drivers, restraints, opportunities, challenges, and competitive scenario to build our analysis.

Data Collection Matrix

|

Data Collection Matrix |

Supply Side |

Demand Side |

|

Primary Data Sources |

|

|

|

Secondary Data Sources |

|

|

Market Modeling and Forecasting

We use epidemiology and capital equipment-based models to forecast market size of different segments at country and regional level.

- Epidemiology-based Forecasting Model: This method uses epidemiology data gathered through various publications and from physicians to estimate population of patients, flow of treatment of individual disease and therapies. The data collected through this method includes statics on incidence of disease, population suffering from disease, and treatment population. This method is used to understand:

- Number of patients for particular device or medical procedure and

- Repeated use of particular device depending on health and condition of patient

- Capital-based Forecasting Model: This method of forecasting is based on number of replacements, installed-based and new sales of capital equipment used in various healthcare and diagnostic centers. These three parameters are calculated and forecast is developed. Installation base is calculated as average number of units per facility; while sales for particular year is calculated from number of new and replace units. Secondary data is collected through various supply chain intermediaries and opinion leaders to arrive at installation and sales rate. These techniques help our analysts in validating market and developed market estimates and forecast.

We do forecast on basis of several parameters such as market drivers, market opportunities, industry trends government regulations, raw materials supply and trade dynamics to ensure relevance of forecast with market scenario. With increasing need to granulized information, we used bottom-up methodology for forecasting where we evaluate each regional segment differently and combined all forecast to develop final market forecast.

Data Validation

We believe primary research is a very important tool in analyzing and forecasting different markets. In order to make sure accuracy of our findings, our team conducts primary interviews at every stage of research to gain deep insights into current business environment and future trends and key developments in market. This includes use of various methods such as telephonic interviews, focus groups, face to face interviews and questionnaires to validate our research from all aspects. We validate our data through primary research from key industry leaders such as CEO, product managers, marketing managers, suppliers, distributors, and consumers are frequently interviewed. These interviews provide valuable insights which help us to have better market understanding besides validating our estimates and forecast.

Data Triangulation

Industry Analysis

|

Qualitative Data |

Quantitative Data (2017-2025) |

|

|