.png)

Silicone Elastomer Market by Product and Application - Global Industry Analysis and Forecast to 2023

Published On : February 2018 Pages : 80 Category: Plastics, Polymers & Resins Report Code : CM02589

SEGMENTS & REGIONS:

- Regions: North America, Europe, Asia- Pacific, Latin America, Middle East & Africa

Industry Trend Analysis

In 2017, the global silicone elastomers market was evaluated around USD billion and is expected to reach approximately USD billion by 2023 while registering itself at a compound annual growth rate (CAGR) of % over the forecast period. Technological innovations in products based on encouraging mechanical and chemical properties are expected to boost the global market for the approaching years. Population statistics in Japan, China, Germany, and the U.S. is anticipated to detect significant geriatric population in comparison with the emerging regions. The desire to stay presentable yet at old age is expected to boost the cosmetic surgery industry, which will consecutively influence the growth of silicone elastomers market positively. Advanced properties of elastomers involving tear resistance, low surface friction, self-adhesive nature, and thermal resistance make its products extremely precious for different applications like automotive, industrial, consumer goods, medical, healthcare, electrical & electronics, and construction segments. R&D initiatives by market players to develop robust products that have a wide application base are anticipated to generate massive growth opportunities for market participants.

Product Outlook and Trend Analysis

In 2017, high temperature vulcanize (HTV) appeared as the major product segment concerning volume and reported for around % of the total demand. Rising demand in the major end-user industries like electrical & electronics and automotive, particularly in emerging regions, is anticipated to be a major fueling factor for the product segment. Room temperature vulcanize (RTV) is projected to grow at the highest compound annual growth rate over the forecast period. This product is utilized frequently in low-temperature applications like sealing, bonding, over-molding, lens, and manufacturing other molds in healthcare, electrical & electronics, construction, medical industries. Liquid silicone rubber (LSR) is anticipated to achieve market share during the next few years. Rising demand in different applications like injection molding that is dominant over multiple end-user industries like furniture, toys, storage containers, medical equipment, packaging, housewares, musical instruments, consumer goods, and automotive may be assigned to the elevated growth of this product section.

Application Outlook and Trend Analysis

Rising disposable earnings due to growing countries in Asia Pacific is expected to boost the expansion of automotive & transportation segment over the projected period. In 2017, demand in construction segment reported for around % and is expected to be the leading segment during the next few years. Increasing construction expenditure in developing countries like Brazil, India, and China is expected to positively influence the industry demand. Rising product demand in electronics & electrical market is anticipated to boost market share by % during the next few years. This rise can be assigned to strong demand and increasing industrialization & urbanization.

Regional Outlook and Trend Analysis

In 2017, Asia Pacific regional silicone elastomers market reported for around % of the global market revenue. Construction expenditure in Indonesia, Malaysia, South Korea, Vietnam, India, and China is anticipated to encourage the regional market demand. Asia Pacific region is projected to experience high automotive and electrical & electronics due to increasing disposable earnings and rising population, thus assisting the regional silicone elastomers industry. The European regional market is anticipated to grow at a compound annual growth rate of % throughout the forecast years. Rising automotive technological center in Germany is expected to fuel the industry demand. Other nations including France, Italy, and the UK show considerable growth during the forecast period. North American regional market demand is expected to drive at a compound annual growth rate of % over the projected period. Rising popularity of the cosmetic surgical procedure and geriatric population in the United States is expected to influence the regional demand positively.

Competitive Outlook and Trend Analysis

The global silicone elastomers market shows monopoly nature and is distinguished by regular mergers & acquisitions. Market players are involved in extensive R&D to enhance their product range and reinforce their market presence. Key market participants in the global silicone elastomers market are Wacker Chemie AG, Dow Corning Corporation, KCC Corporation, Momentive Performance Materials Inc., Shin-Etsu Chemical Co. Ltd. ICM Products Group, Elkem AS, Mesgo S.p.A., Reiss Manufacturing, Inc., Specialty Silicone Products Inc., Allergan, Arlon Silicone Technologies, ELMET, ContiTech AG, Marsh Bellofram, Bentec Medical Incorporated, AkzoNobel, Sigmasoft Engineering GmbH, Momentive, Rogers Corporation, and Saint-Gobain SA.

The global silicone elastomers market is segmented as follows –

By Product

- High Temperature Vulcanize (HTV)

- Room Temperature Vulcanize (RTV)

- Liquid Silicone Rubber (LSR)

By Application

- Electrical & Electronics

- Automotive & Transportation

- Industrial Machinery

- Consumer Goods

- Construction

- Others

By Region

- North America

- U.S

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- Japan

- China

- Australia

- India

- South Korea

- Rest of Asia Pacific

- Rest of the World

- Brazil

- South Africa

- Saudi Arabia

- United Arab Emirates

- Others

Some of the key questions answered by the report are:

· What was the market size in 2017 and forecast from 2017 to 2023?

· What will be the industry market growth from 2017 to 2023?

· What are the major drivers, restraints, opportunities, challenges, and industry trends and their impact on the market forecast?

· What are the major segments leading the market growth and why?

· Which are the leading players in the market and what are the major strategies adopted by them to sustain the market competition?

Market Classification

- Silicone Elastomer Market, By Product, Estimates and Forecast, 2014-2023 ($Million)

- High Temperature Vulcanize (HTV)

- Room Temperature Vulcanize (RTV)

- Liquid Silicone Rubber (LSR)

- Silicone Elastomer Market, By Application, Estimates and Forecast, 2014-2023 ($Million)

- Electrical & Electronics

- Automotive & Transportation

- Industrial Machinery

- Consumer Goods

- Construction

- Other Applications

- Silicone Elastomer Market, By Region, Estimates and Forecast, 2014-2023 ($Million)

- North America

- North America Silicone Elastomer Market, By Country

- North America Silicone Elastomer Market, By Product

- North America Silicone Elastomer Market, By Application

- U.S. Silicone Elastomer Market, By Product

- U.S. Silicone Elastomer Market, By Application

- Canada Silicone Elastomer Market, By Product

- Canada Silicone Elastomer Market, By Application

- Mexico Silicone Elastomer Market, By Product

- Mexico Silicone Elastomer Market, By Application

-

- Europe

- Europe Silicone Elastomer Market, By Country

- Europe Silicone Elastomer Market, By Product

- Europe Silicone Elastomer Market, By Application

- Germany Silicone Elastomer Market, By Product

- Germany Silicone Elastomer Market, By Application

- France Silicone Elastomer Market, By Product

- France Silicone Elastomer Market, By Application

- UK Silicone Elastomer Market, By Product

- UK Silicone Elastomer Market, By Application

- Italy Silicone Elastomer Market, By Product

- Italy Silicone Elastomer Market, By Application

- Spain Silicone Elastomer Market, By Product

- Spain Silicone Elastomer Market, By Application

- Rest of Europe Silicone Elastomer Market, By Product

- Rest of Europe Silicone Elastomer Market, By Application

-

- Asia-Pacific

- Asia-Pacific Silicone Elastomer Market, By Country

- Asia-Pacific Silicone Elastomer Market, By Product

- Asia-Pacific Silicone Elastomer Market, By Application

- Japan Silicone Elastomer Market, By Product

- Japan Silicone Elastomer Market, By Application

- Australia Silicone Elastomer Market, By Product

- Australia Silicone Elastomer Market, By Application

- India Silicone Elastomer Market, By Product

- India Silicone Elastomer Market, By Application

- South Korea Silicone Elastomer Market, By Product

- South Korea Silicone Elastomer Market, By Application

- Rest of Asia-Pacific Silicone Elastomer Market, By Product

- Rest of Asia-Pacific Silicone Elastomer Market, By Application

- Asia-Pacific

-

- Rest of the World

- Rest of the World Silicone Elastomer Market, By Country

- Rest of the World Silicone Elastomer Market, By Product

- Rest of the World Silicone Elastomer Market, By Application

- Brazil Silicone Elastomer Market, By Product

- Brazil Silicone Elastomer Market, By Application

- South Africa Silicone Elastomer Market, By Product

- South Africa Silicone Elastomer Market, By Application

- Saudi Arabia Silicone Elastomer Market, By Product

- Saudi Arabia Silicone Elastomer Market, By Application

- Turkey Silicone Elastomer Market, By Product

- Turkey Silicone Elastomer Market, By Application

- United Arab Emirates Silicone Elastomer Market, By Product

- United Arab Emirates Silicone Elastomer Market, By Application

- Others Silicone Elastomer Market, By Product

- Others Silicone Elastomer Market, By Application

- Rest of the World

Table of Contents

1. Introduction

1.1. Report Description

1.2. Research Methodology

2. Executive Summary

2.1. Key Highlights

3. Market Overview

3.1. Introduction

3.1.1. Market Definition

3.1.2. Market Segmentation

3.2. Market Dynamics

3.2.1. Drivers

3.2.1.1. Superior Properties of Silicone Elastomers

3.2.1.2. Increasing Scope in the Healthcare Industry

3.2.1.3. High Demand from the Electrical & Electronics Industry

3.2.2. Restraints

3.2.2.1. High Cost of the Products

3.2.3. Opportunities

3.2.3.1. Emerging Markets to Offer Lucrative Growth Opportunities

4. Silicone Elastomers Market, By Product

4.1. Introduction

4.2. Global Silicone Elastomers Sales, Revenue and Market Share by Product (2017-2017)

4.2.1. Global Silicone Elastomers Sales and Sales Share by Product (2017-2017)

4.2.2. Global Silicone Elastomers Revenue and Revenue Share by Product (2017-2017)

4.3. Silicone Elastomers Market Assessment and Forecast, By Product, 2017-2023

4.4. High Temperature Vulcanize (HTV)

4.4.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

4.5. Room Temperature Vulcanize (RTV)

4.5.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

4.6. Liquid Silicone Rubber (LSR)

4.6.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

5. Silicone Elastomers Market, By Application

5.1. Introduction

5.2. Global Silicone Elastomers Sales, Revenue and Market Share by Application (2017-2017)

5.2.1. Global Silicone Elastomers Sales and Sales Share by Application (2017-2017)

5.2.2. Global Silicone Elastomers Revenue and Revenue Share by Application (2017-2017)

5.3. The Silicone Elastomers Market Assessment and Forecast, By Application, 2017-2023

5.4. Electrical & Electronics

5.4.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

5.5. Automotive & Transportation

5.5.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

5.6. Industrial Machinery

5.6.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

5.7. Consumer Goods

5.7.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

5.8. Construction

5.8.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

5.9. Other Applications

5.9.1. Market Assessment and Forecast, By Region, 2017-2023 ($Million)

6. Silicone Elastomers Market, By Region

6.1. Introduction

6.2. Silicone Elastomers Market Assessment and Forecast, By Region, 2017-2023 ($Million)

6.3. Global Silicone Elastomers Sales, Revenue and Market Share by Regions

6.3.1. Global Silicone Elastomers Sales by Regions (2017-2017)

6.3.2. Global Silicone Elastomers Revenue by Regions (2017-2017)

6.4. North America

6.4.1. North America Silicone Elastomers Sales and Growth Rate (2017-2017)

6.4.2. Market Assessment and Forecast, By Country, 2017-2023 ($Million)

6.4.3. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

6.4.4. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.4.5. U.S.

6.4.5.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

6.4.5.2. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.4.6. Canada

6.4.6.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

6.4.6.2. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.4.7. Mexico

6.4.7.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

6.4.7.2. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.5. Europe

6.5.1. Europe Silicone Elastomers Sales and Growth Rate (2017-2017)

6.5.2. Market Assessment and Forecast, By Country, 2017-2023 ($Million)

6.5.3. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

6.5.4. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.5.5. Germany

6.5.5.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

6.5.5.2. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.5.6. France

6.5.6.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

6.5.6.2. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.5.7. UK

6.5.7.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

6.5.7.2. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.5.8. Italy

6.5.8.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

6.5.8.2. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.5.9. Spain

6.5.9.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

6.5.9.2. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.5.10. Rest of Europe

6.5.10.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

6.5.10.2. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.6. Asia-Pacific

6.6.1. Asia-Pacific Silicone Elastomers Sales and Growth Rate (2017-2017)

6.6.2. Market Assessment and Forecast, By Country, 2017-2023 ($Million)

6.6.3. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

6.6.4. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.6.5. Japan

6.6.5.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

6.6.5.2. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.6.6. China

6.6.6.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

6.6.6.2. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.6.7. Australia

6.6.7.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

6.6.7.2. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.6.8. India

6.6.8.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

6.6.8.2. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.6.9. South Korea

6.6.9.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

6.6.9.2. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.6.10. Rest of Asia-Pacific

6.6.10.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

6.6.10.2. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.7. Rest of the World

6.7.1. Rest of the World Silicone Elastomers Sales and Growth Rate (2017-2017)

6.7.2. Market Assessment and Forecast, By Country, 2017-2023 ($Million)

6.7.3. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

6.7.4. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.7.5. Brazil

6.7.5.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

6.7.5.2. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.7.6. Turkey

6.7.6.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

6.7.6.2. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.7.7. Saudi Arabia

6.7.7.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

6.7.7.2. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.7.8. South Africa

6.7.8.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

6.7.8.2. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.7.9. United Arab Emirates

6.7.9.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

6.7.9.2. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

6.7.10. Others

6.7.10.1. Market Assessment and Forecast, By Product, 2017-2023 ($Million)

6.7.10.2. Market Assessment and Forecast, By Application, 2017-2023 ($Million)

7. Company Profiles

7.1. China National Bluestar (Group) Co. Ltd.

7.1.1. Business Overview

7.1.2. Product Portfolio

7.1.3. Strategic Developments

7.1.4. Silicone Elastomers Sales, Revenue and Market Share

7.2. Dow Corning Corporation

7.2.1. Business Overview

7.2.2. Product Portfolio

7.2.3. Strategic Developments

7.2.4. Silicone Elastomers Sales, Revenue and Market Share

7.3. KCC Corporation

7.3.1. Business Overview

7.3.2. Product Portfolio

7.3.3. Strategic Developments

7.3.4. Silicone Elastomers Sales, Revenue and Market Share

7.4. Mesgo S.P.A.

7.4.1. Business Overview

7.4.2. Product Portfolio

7.4.3. Strategic Developments

7.4.4. Silicone Elastomers Sales, Revenue and Market Share

7.5. Momentive Performance Materials Inc.

7.5.1. Business Overview

7.5.2. Product Portfolio

7.5.3. Strategic Developments

7.5.4. Silicone Elastomers Sales, Revenue and Market Share

7.6. Shin-Etsu Chemical Co., Ltd.

7.6.1. Business Overview

7.6.2. Product Portfolio

7.6.3. Strategic Developments

7.6.4. Silicone Elastomers Sales, Revenue and Market Share

7.7. Reiss Manufacturing Inc.

7.7.1. Business Overview

7.7.2. Product Portfolio

7.7.3. Strategic Developments

7.7.4. Silicone Elastomers Sales, Revenue and Market Share

7.8. Wacker Chemie AG

7.8.1. Business Overview

7.8.2. Product Portfolio

7.8.3. Strategic Developments

7.8.4. Silicone Elastomers Sales, Revenue and Market Share

7.9. Zhejiang Xinan Chemical Industrial Group Co., Ltd.

7.9.1. Business Overview

7.9.2. Product Portfolio

7.9.3. Strategic Developments

7.9.4. Silicone Elastomers Sales, Revenue and Market Share

7.10. Stockwell Elastomerics

7.10.1. Business Overview

7.10.2. Product Portfolio

7.10.3. Strategic Developments

7.10.4. Silicone Elastomers Sales, Revenue and Market Share

7.11. Specialty Silicone Products, Inc.

7.11.1. Business Overview

7.11.2. Product Portfolio

7.11.3. Strategic Developments

7.11.4. Silicone Elastomers Sales, Revenue and Market Share

8. Global Silicone Elastomers Market Competition, by Manufacturer

8.1. Global Silicone Elastomers Sales and Market Share by Manufacturer (2017-2017)

8.2. Global Silicone Elastomers Revenue and Market Share by Manufacturer (2017-2017)

8.3. Top 5 Silicone Elastomers Manufacturer Market Share

8.4. Market Competition Trend

List of Tables

*You can glance through the list of Tables and Figures when you view the sample copy of Silicone Elastomers Market.

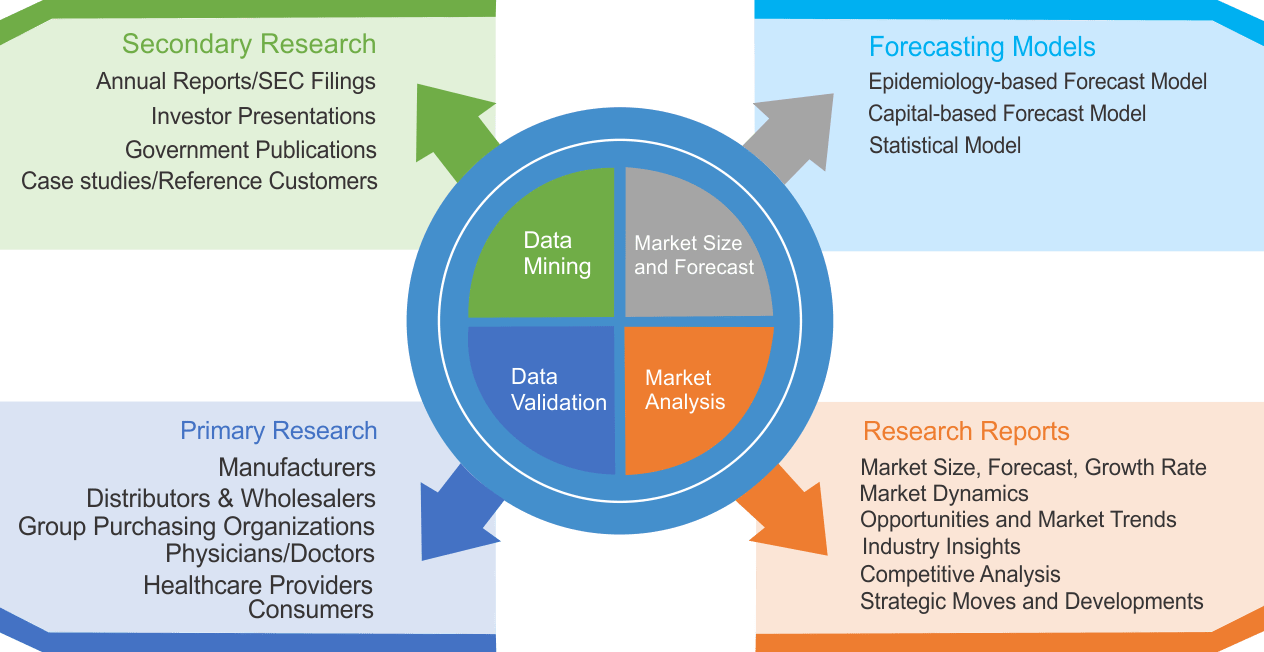

Research Methodology

We use both primary as well as secondary research for our market surveys, estimates and for developing forecast. Our research process commence by analyzing the problem which enable us to design the scope for our research study. Our research process is uniquely designed with enough flexibility to adjust according to changing nature of products and markets, while retaining core element to ensure reliability and accuracy in research findings. We understand both macro and micro-economic factors to evaluate and forecast different market segments.

Data Mining

Data is extensively collected through various secondary sources such as annual reports, investor presentations, SEC filings, and other corporate publications. We also refer trade magazines, technical journals, paid databases such as Factiva and Bloomberg, industry trade journals, scientific journals, and social media data to understand market dynamics and industry trends. Further, we also conduct primary research to understand market drivers, restraints, opportunities, challenges, and competitive scenario to build our analysis.

Data Collection Matrix

|

Data Collection Matrix |

Supply Side |

Demand Side |

|

Primary Data Sources |

|

|

|

Secondary Data Sources |

|

|

Market Modeling and Forecasting

We use epidemiology and capital equipment-based models to forecast market size of different segments at country and regional level.

- Epidemiology-based Forecasting Model: This method uses epidemiology data gathered through various publications and from physicians to estimate population of patients, flow of treatment of individual disease and therapies. The data collected through this method includes statics on incidence of disease, population suffering from disease, and treatment population. This method is used to understand:

- Number of patients for particular device or medical procedure and

- Repeated use of particular device depending on health and condition of patient

- Capital-based Forecasting Model: This method of forecasting is based on number of replacements, installed-based and new sales of capital equipment used in various healthcare and diagnostic centers. These three parameters are calculated and forecast is developed. Installation base is calculated as average number of units per facility; while sales for particular year is calculated from number of new and replace units. Secondary data is collected through various supply chain intermediaries and opinion leaders to arrive at installation and sales rate. These techniques help our analysts in validating market and developed market estimates and forecast.

We do forecast on basis of several parameters such as market drivers, market opportunities, industry trends government regulations, raw materials supply and trade dynamics to ensure relevance of forecast with market scenario. With increasing need to granulized information, we used bottom-up methodology for forecasting where we evaluate each regional segment differently and combined all forecast to develop final market forecast.

Data Validation

We believe primary research is a very important tool in analyzing and forecasting different markets. In order to make sure accuracy of our findings, our team conducts primary interviews at every stage of research to gain deep insights into current business environment and future trends and key developments in market. This includes use of various methods such as telephonic interviews, focus groups, face to face interviews and questionnaires to validate our research from all aspects. We validate our data through primary research from key industry leaders such as CEO, product managers, marketing managers, suppliers, distributors, and consumers are frequently interviewed. These interviews provide valuable insights which help us to have better market understanding besides validating our estimates and forecast.

Data Triangulation

Industry Analysis

|

Qualitative Data |

Quantitative Data (2017-2025) |

|

|