Drug Discovery Technologies Market By End User (pharmaceutical Companies, Biopharmaceutical Companies, Biotech Companies And Research Institutes) And Technology (high Throughput Screening, Genomics, Biochips, Pharmacogenomics, Bioanalytical Instruments, Bioinformatics, Nanotechnology And Other Technologies) - Global Industry Analysis And Forecast To 2023

Published On : July 2018 Pages : 190 Category: Biotechnology Report Code : HC071094

Industry Outlook and Trend Analysis

The Drug Discovery Technologies Market is expected to witness considerable growth during the forecast period. Drug discovery is a procedure wherein new medications are recognized for any malady sign. Creating drug from the phase of revelation to market endorsement is a long procedure which adds to critical expenses to the engineers. Primary focal point of Research and development is into identification of an objective and disclosure of some compound which can enact or hinder the objective. The primary reasons of medication failure are absence of viability and security of found medication competitor, prompting money related misfortunes to the organizations. To hinder such possibilities, the status of effective medication disclosure process has turned out to be basic in the field of medication advancement.

Drivers & Restrains

Major market drivers of drug discovery is comprehensively growing populace, rising pervasiveness of various scope of ailment incorporating neurology, cardiovascular, oncology and other interminable infection territories. Some tropical irresistible illnesses still need proper restorative mediations. Pharmaceutical arrangements are required to address this difficulty and furthermore to conquer extreme issues like anti-toxin opposition. Number of ways are distinguished and being investigated to reinforce the drug discovery technologies market in future years by encouraging licensed development in free access stage, growing new metrics for catching information of open research and changing administrative rules by allotting specific assignment for products. Expanding research financing from administrative associations and pharmaceutical producers and patent lapse of promoted drugs are the significant purposes for the smooth advance of drug discovery technologies market around the world. Presentation of new advancements is relied upon to heighten the market development in coming a very long time by productively recognizing promising medication and diminishing the odds of disappointment.

Regional Outlook and Trend Analysis

North America is expected to witness considerable growth over the forecast period. The interest for drug discovery technologies in the district of North America additionally picks up from high-wage populace, by and large encouraging sound potential profits for ventures because of high appropriation rate of new advances. Asia Pacific holds colossal guarantee as a business opportunity for sedate disclosure advancements because of rising dispensable livelihoods, positive long haul government approaches, and forceful speculation by pharmaceutical industry in the district, which has skilled labour at reasonable cost.

Competitive Insights

The leading players in the market are Celera Corp, Bio-Rad Laboratories, Albany Molecular Research, Evotec Ag and others. The major players in the market are profiled in detail in view of qualities, for example, company portfolio, business strategies, financial overview, recent developments, and share of the overall industry.

The Drug Discovery Technologies Market is segmented as follows-

By Technology:

- High throughput screening

- Genomics

- Biochips

- Pharmacogenomics

- Bioanalytical instruments

- Bioinformatics

- Nanotechnology

- Other Technologies

By End User:

- Pharmaceutical companies

- Biopharmaceutical companies

- Biotech companies

- Research institutes

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Russia

- Italy

- Rest of Europe

- Asia-Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Columbia

- South Africa

- Rest of South America

- Middle East and Africa

- Saudi Arabia

- UAE

- Egypt

- Nigeria

- South Africa

- Rest of MEA

Some of the key questions answered by the report are:

- What was the market size in 2017 and forecast from 2017 to 2023?

- What will be the industry market growth from 2017 to 2023?

- What are the major drivers, restraints, opportunities, challenges, and industry trends and their impact on the market forecast?

- What are the major segments leading the market growth and why?

- Which are the leading players in the market and what are the major strategies adopted by them to sustain the market competition?

Market Classification

· Drug Discovery Technologies Market, By End User, Estimates and Forecast, 2014-2023 ($Million)

· Pharmaceutical companies

· Biopharmaceutical companies

· Biotech companies

· Research institutes

· Drug Discovery Technologies Market, By Technology, Estimates and Forecast, 2014-2023 ($Million)

· High throughput screening

· Genomics

· Biochips

· Pharmacogenomics

· Bioanalytical instruments

· Bioinformatics

· Nanotechnology

· Other Technologies

· Drug Discovery Technologies Market, By Region, Estimates and Forecast, 2014-2023 ($Million)

· North America

§ North America Drug Discovery Technologies Market, By Country

o U.S. Drug Discovery Technologies Market

o Canada Drug Discovery Technologies Market

o Mexico Drug Discovery Technologies Market

· Europe

§ Europe Drug Discovery Technologies Market, By Country

o Germany Drug Discovery Technologies Market

o UK Drug Discovery Technologies Market

o France Drug Discovery Technologies Market

o Russia Drug Discovery Technologies Market

o Italy Drug Discovery Technologies Market

o Rest of Europe Drug Discovery Technologies Market

· Asia-Pacific

§ Asia-Pacific Drug Discovery Technologies Market, By Country

o China Drug Discovery Technologies Market

o Japan Drug Discovery Technologies Market

o South Korea Drug Discovery Technologies Market

o India Drug Discovery Technologies Market

o Southeast Asia Drug Discovery Technologies Market

o Rest of Asia-Pacific Drug Discovery Technologies Market

· South America

§ South America Drug Discovery Technologies Market

o Brazil Drug Discovery Technologies Market

o Argentina Drug Discovery Technologies Market

o Columbia Drug Discovery Technologies Market

o South Africa Drug Discovery Technologies Market

o Rest of South America Drug Discovery Technologies Market

· Middle East and Africa

§ Middle East and Africa Drug Discovery Technologies Market

o Saudi Arabia Drug Discovery Technologies Market

o UAE Drug Discovery Technologies Market

o Egypt Drug Discovery Technologies Market

o Nigeria Drug Discovery Technologies Market

o South Africa Drug Discovery Technologies Market

o Rest of MEA Drug Discovery Technologies Market

Table of Contents

1. Introduction

1.1. Report Description

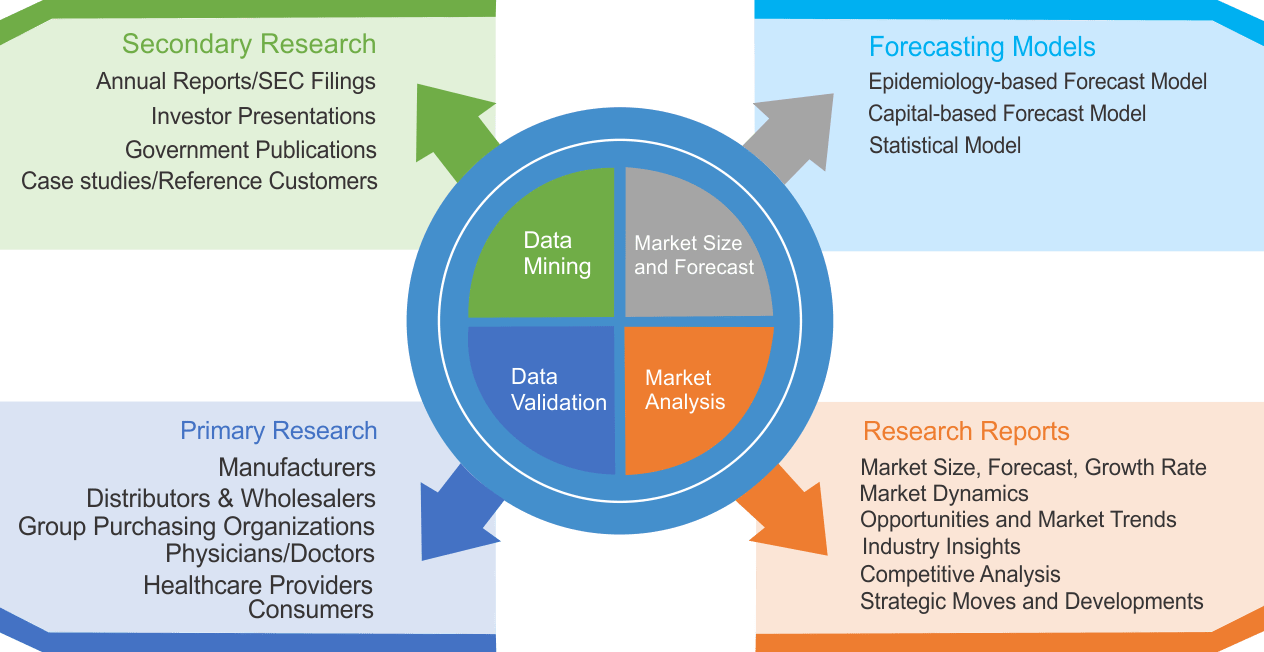

1.2. Research Methodology

1.2.1. Secondary Research

1.2.2. Primary Research

2. Executive Summary

2.1. Key Highlights

3. Market Overview

3.1. Introduction

3.1.1. Market Definition

3.1.2. Market Segmentation

3.2. Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunities

4. Market Analysis by Regions

4.1. North America (United States, Canada and Mexico)

4.1.1. United States Market States and Outlook (2017-2023)

4.1.2. Canada Market States and Outlook (2017-2023)

4.1.3. Mexico Market States and Outlook (2017-2023)

4.2. Europe (Germany, France, UK, Russia, Italy and Rest of Europe)

4.2.1. Germany Market States and Outlook (2017-2023)

4.2.2. France Market States and Outlook (2017-2023)

4.2.3. UK Market States and Outlook (2017-2023)

4.2.4. Russia Market States and Outlook (2017-2023)

4.2.5. Italy Market States and Outlook (2017-2023)

4.2.6. Rest of Europe Market States and Outlook (2017-2023)

4.3. Asia-Pacific (China, Japan, Korea, India, Southeast Asia and Rest of Asia-Pacific)

4.3.1. China Market States and Outlook (2017-2023)

4.3.2. Japan Market States and Outlook (2017-2023)

4.3.3. Korea Market States and Outlook (2017-2023)

4.3.4. India Market States and Outlook (2017-2023)

4.3.5. Rest of Asia-Pacific Market States and Outlook (2017-2023)

4.4. South America (Brazil, Argentina, Columbia and Rest of South America)

4.4.1. Brazil Market States and Outlook (2017-2023)

4.4.2. Argentina Market States and Outlook (2017-2023)

4.4.3. Columbia Market States and Outlook (2017-2023)

4.4.4. Rest of South America Market States and Outlook (2017-2023)

4.5. Middle East and Africa (Saudi Arabia, UAE, Egypt, Nigeria, South Africa and Rest of MEA)

4.5.1. Saudi Arabia Market States and Outlook (2017-2023)

4.5.2. UAE Market States and Outlook (2017-2023)

4.5.3. Egypt Market States and Outlook (2017-2023)

4.5.4. Nigeria Market States and Outlook (2017-2023)

4.5.5. South Africa Market States and Outlook (2017-2023)

4.5.6. Rest of MEA Market States and Outlook (2017-2023)

5. Drug Discovery Technologies Market, By End User

5.1. Introduction

5.2. Global Drug Discovery Technologies Revenue and Market Share by End User (2017-2027)

5.2.1. Global Drug Discovery Technologies Revenue and Revenue Share by End User (2017-2027)

5.3. Pharmaceutical companies

5.3.1. Global Pharmaceutical companies Revenue and Growth Rate (2017-2027)

5.4. Biopharmaceutical companies

5.4.1. Global Biopharmaceutical companies Revenue and Growth Rate (2017-2027)

5.5. Biotech companies

5.5.1. Global Biotech companies Revenue and Growth Rate (2017-2027)

5.6. Research institutes

5.6.1. Global Research institutes Revenue and Growth Rate (2017-2027)

6. Drug Discovery Technologies Market, By Technology

6.1. Introduction

6.2. Global Drug Discovery Technologies Revenue and Market Share by Technology (2017-2027)

6.2.1. Global Drug Discovery Technologies Revenue and Revenue Share by Technology (2017-2027)

6.3. High throughput screening

6.3.1. Global High throughput screening Revenue and Growth Rate (2017-2027)

6.4. Genomics

6.4.1. Global Genomics Revenue and Growth Rate (2017-2027)

6.5. Biochips

6.5.1. Global Biochips Revenue and Growth Rate (2017-2027)

6.6. Pharmacogenomics

6.6.1. Global Pharmacogenomics Revenue and Growth Rate (2017-2027)

6.7. Bioanalytical instruments

6.7.1. Global Bioanalytical instruments Revenue and Growth Rate (2017-2027)

6.8. Bioinformatics

6.8.1. Global Bioinformatics Revenue and Growth Rate (2017-2027)

6.9. Nanotechnology

6.9.1. Global Nanotechnology Revenue and Growth Rate (2017-2027)

6.10. Other Technologies

6.10.1. Global Other Technologies Revenue and Growth Rate (2017-2027)

7. Drug Discovery Technologies Market, By Region

7.1. Introduction

7.2. Global Drug Discovery Technologies Revenue and Market Share by Regions

7.2.1. Global Drug Discovery Technologies Revenue by Regions (2017-2027)

7.3. North America Drug Discovery Technologies by Countries

7.3.1. North America Drug Discovery Technologies Revenue and Growth Rate (2017-2027)

7.3.2. North America Drug Discovery Technologies Revenue by Countries (2017-2027)

7.3.3. North America Drug Discovery Technologies Revenue (Million USD) by Countries (2017-2027)

7.3.4. U.S.

7.3.4.1. United States Drug Discovery Technologies Revenue (Millions USD) and Growth Rate (2017-2027)

7.3.5. Canada

7.3.5.1. Canada Drug Discovery Technologies Revenue (Millions USD) and Growth Rate (2017-2027)

7.3.6. Mexico

7.3.6.1. Mexico Drug Discovery Technologies Revenue (Millions USD) and Growth Rate (2017-2027)

7.4. Europe Drug Discovery Technologies by Countries

7.4.1. Europe Drug Discovery Technologies Revenue and Growth Rate (2017-2027)

7.4.2. Europe Drug Discovery Technologies Revenue by Countries (2017-2027)

7.4.3. Europe Drug Discovery Technologies Revenue (Million USD) by Countries (2017-2027)

7.4.4. Germany

7.4.4.1. Germany Drug Discovery Technologies Revenue (Millions USD) and Growth Rate (2017-2027)

7.4.5. UK

7.4.5.1. UK Drug Discovery Technologies Revenue (Millions USD) and Growth Rate (2017-2027)

7.4.6. France

7.4.6.1. France Drug Discovery Technologies Revenue (Millions USD) and Growth Rate (2017-2027)

7.4.7. Russia

7.4.7.1. Russia Drug Discovery Technologies Revenue (Millions USD) and Growth Rate (2017-2027)

7.4.8. Italy

7.4.8.1. Italy Drug Discovery Technologies Revenue (Millions USD) and Growth Rate (2017-2027)

7.4.9. Rest of Europe

7.4.9.1. Rest of Europe Drug Discovery Technologies Revenue (Millions USD) and Growth Rate (2017-2027)

7.5. Asia-Pacific

7.5.1. Asia-Pacific Drug Discovery Technologies Revenue and Growth Rate (2017-2027)

7.5.2. Asia-Pacific Drug Discovery Technologies Revenue by Countries (2017-2027)

7.5.3. Asia-Pacific Drug Discovery Technologies Revenue (Million USD) by Countries (2017-2027)

7.5.4. China

7.5.4.1. China Drug Discovery Technologies Revenue (Millions USD) and Growth Rate (2017-2027)

7.5.5. Japan

7.5.5.1. Japan Drug Discovery Technologies Revenue (Millions USD) and Growth Rate (2017-2027)

7.5.6. Korea

7.5.6.1. Korea Drug Discovery Technologies Revenue (Millions USD) and Growth Rate (2017-2027)

7.5.7. India

7.5.7.1. India Drug Discovery Technologies Revenue (Millions USD) and Growth Rate (2017-2027)

7.5.8. Southeast Asia

7.5.8.1. Southeast Asia Drug Discovery Technologies Revenue (Millions USD) and Growth Rate (2017-2027)

7.5.9. Rest of Asia-Pacific

7.5.9.1. Rest of Asia-Pacific Drug Discovery Technologies Revenue (Millions USD) and Growth Rate (2017-2027)

7.6. South America

7.6.1. South America Drug Discovery Technologies Revenue and Growth Rate (2017-2027)

7.6.2. South America Drug Discovery Technologies Revenue by Countries (2017-2027)

7.6.3. South America Drug Discovery Technologies Revenue (Million USD) by Countries (2017-2027)

7.6.4. Brazil

7.6.4.1. Brazil Drug Discovery Technologies Revenue (Millions USD) and Growth Rate (2017-2027)

7.6.5. Argentina

7.6.5.1. Argentina Drug Discovery Technologies Revenue (Millions USD) and Growth Rate (2017-2027)

7.6.6. Columbia

7.6.6.1. Columbia Drug Discovery Technologies Revenue (Millions USD) and Growth Rate (2017-2027)

7.6.7. Rest of South America

7.6.7.1. Rest of South America Drug Discovery Technologies Revenue (Millions USD) and Growth Rate (2017-2027)

7.7. Middle East and Africa

7.7.1. Middle East and Africa Drug Discovery Technologies Revenue and Growth Rate (2017-2027)

7.7.2. Middle East and Africa Drug Discovery Technologies Revenue by Countries (2017-2027)

7.7.3. Middle East and Africa Drug Discovery Technologies Revenue (Million USD) by Countries (2017-2027)

7.7.4. Saudi Arabia

7.7.4.1. Saudi Arabia Drug Discovery Technologies Revenue (Millions USD) and Growth Rate (2017-2027)

7.7.5. United Arab Emirates

7.7.5.1. United Arab Emirates Drug Discovery Technologies Revenue (Millions USD) and Growth Rate (2017-2027)

7.7.6. Egypt

7.7.6.1. Egypt Drug Discovery Technologies Revenue (Millions USD) and Growth Rate (2017-2027)

7.7.7. Nigeria

7.7.7.1. Nigeria Drug Discovery Technologies Revenue (Millions USD) and Growth Rate (2017-2027)

7.7.8. South Africa

7.7.8.1. South Africa Drug Discovery Technologies Revenue (Millions USD) and Growth Rate (2017-2027)

7.7.9. Rest of Middle East and Africa

7.7.9.1. Rest of Middle East and Africa Drug Discovery Technologies Revenue (Millions USD) and Growth Rate (2017-2027)

8. Company Profiles

8.1. Abbott Laboratories

8.1.1. Business Overview

8.1.2. Product Portfolio

8.1.3. Strategic Developments

8.1.4. Revenue and Market Share

8.2. Albany Molecular Research

8.2.1. Business Overview

8.2.2. Product Portfolio

8.2.3. Strategic Developments

8.2.4. Revenue and Market Share

8.3. Arqule

8.3.1. Business Overview

8.3.2. Product Portfolio

8.3.3. Strategic Developments

8.3.4. Revenue and Market Share

8.4. Bio-Rad Laboratories

8.4.1. Business Overview

8.4.2. Product Portfolio

8.4.3. Strategic Developments

8.4.4. Revenue and Market Share

8.5. Caliper Life Sciences

8.5.1. Business Overview

8.5.2. Product Portfolio

8.5.3. Strategic Developments

8.5.4. Revenue and Market Share

8.6. Celera Corp

8.6.1. Business Overview

8.6.2. Product Portfolio

8.6.3. Strategic Developments

8.6.4. Revenue and Market Share

8.7. Charles River Laboratories International

8.7.1. Business Overview

8.7.2. Product Portfolio

8.7.3. Strategic Developments

8.7.4. Revenue and Market Share

8.8. Evotec Ag

8.8.1. Business Overview

8.8.2. Product Portfolio

8.8.3. Strategic Developments

8.8.4. Revenue and Market Share

8.9. Gyros AbIncyte Corp

8.9.1. Business Overview

8.9.2. Product Portfolio

8.9.3. Strategic Developments

8.9.4. Revenue and Market Share

8.10. Thermo Fisher Scientific Inc.

8.10.1. Business Overview

8.10.2. Product Portfolio

8.10.3. Strategic Developments

8.10.4. Revenue and Market Share

9. Global Drug Discovery Technologies Market Competition, by Manufacturer

9.1. Global Drug Discovery Technologies Revenue and Market Share by Manufacturer (2017-2017)

9.2. Global Drug Discovery Technologies Price by Region (2017-2017)

9.3. Top 5 Drug Discovery Technologies Manufacturer Market Share

9.4. Market Competition Trend

10. Drug Discovery Technologies Market Forecast (2027-2023)

10.1. Global Drug Discovery Technologies Revenue (Millions USD) and Growth Rate (2027-2023)

10.2. Drug Discovery Technologies Market Forecast by Regions (2027-2023)

10.2.1. North America Drug Discovery Technologies Market Forecast (2027-2023)

10.2.1.1. United States Drug Discovery Technologies Market Forecast (2027-2023)

10.2.1.2. Canada Drug Discovery Technologies Market Forecast (2027-2023)

10.2.1.3. Mexico Drug Discovery Technologies Market Forecast (2027-2023)

10.2.2. Europe Drug Discovery Technologies Market Forecast (2027-2023)

10.2.2.1. Germany Drug Discovery Technologies Market Forecast (2027-2023)

10.2.2.2. United Kingdom Drug Discovery Technologies Market Forecast (2027-2023)

10.2.2.3. France Drug Discovery Technologies Market Forecast (2027-2023)

10.2.2.4. Russia Drug Discovery Technologies Market Forecast (2027-2023)

10.2.2.5. Italy Drug Discovery Technologies Market Forecast (2027-2023)

10.2.2.6. Rest of the Europe Drug Discovery Technologies Market Forecast (2027-2023)

10.2.3. Asia-Pacific Drug Discovery Technologies Market Forecast (2027-2023)

10.2.3.1. China Drug Discovery Technologies Market Forecast (2027-2023)

10.2.3.2. Japan Drug Discovery Technologies Market Forecast (2027-2023)

10.2.3.3. Korea Drug Discovery Technologies Market Forecast (2027-2023)

10.2.3.4. India Drug Discovery Technologies Market Forecast (2027-2023)

10.2.3.5. Southeast Asia Drug Discovery Technologies Market Forecast (2027-2023)

10.2.3.6. Rest of Asia-Pacific Drug Discovery Technologies Market Forecast (2027-2023)

10.2.4. South America Drug Discovery Technologies Market Forecast (2027-2023)

10.2.4.1. Brazil Drug Discovery Technologies Market Forecast (2027-2023)

10.2.4.2. Argentina Drug Discovery Technologies Market Forecast (2027-2023)

10.2.4.3. Columbia Drug Discovery Technologies Market Forecast (2027-2023)

10.2.4.4. Rest of South America Drug Discovery Technologies Market Forecast (2027-2023)

10.2.5. Middle East and Africa Drug Discovery Technologies Market Forecast (2027-2023)

10.2.5.1. Saudi Arabia Drug Discovery Technologies Market Forecast (2027-2023)

10.2.5.2. UAE Drug Discovery Technologies Market Forecast (2027-2023)

10.2.5.3. Egypt Drug Discovery Technologies Market Forecast (2027-2023)

10.2.5.4. Nigeria Drug Discovery Technologies Market Forecast (2027-2023)

10.2.5.5. South Africa Drug Discovery Technologies Market Forecast (2027-2023)

10.2.5.6. Rest of MEA Drug Discovery Technologies Market Forecast (2027-2023)

10.3. Drug Discovery Technologies Market Forecast by End User (2027-2023)

10.3.1. Global Drug Discovery Technologies Revenue Forecast by End User (2027-2023)

10.3.2. Global Drug Discovery Technologies Revenue Market Share Forecast by End User (2027-2023)

10.4. Drug Discovery Technologies Market Forecast by Application (2027-2023)

10.4.1. Global Drug Discovery Technologies Revenue Forecast by Application (2027-2023)

10.4.2. Global Drug Discovery Technologies Revenue Market Share Forecast by Application (2027-2023)

10.5. Drug Discovery Technologies Market Forecast by Technology (2027-2023)

10.5.1. Global Drug Discovery Technologies Revenue Forecast by Technology (2027-2023)

10.5.2. Global Drug Discovery Technologies Revenue Market Share Forecast by Technology (2027-2023)

List of Tables

*You can glance through the list of Tables and Figures when you view the sample copy of Drug Discovery Technologies Market.

Research Methodology

We use both primary as well as secondary research for our market surveys, estimates and for developing forecast. Our research process commence by analyzing the problem which enable us to design the scope for our research study. Our research process is uniquely designed with enough flexibility to adjust according to changing nature of products and markets, while retaining core element to ensure reliability and accuracy in research findings. We understand both macro and micro-economic factors to evaluate and forecast different market segments.

Data Mining

Data is extensively collected through various secondary sources such as annual reports, investor presentations, SEC filings, and other corporate publications. We also refer trade magazines, technical journals, paid databases such as Factiva and Bloomberg, industry trade journals, scientific journals, and social media data to understand market dynamics and industry trends. Further, we also conduct primary research to understand market drivers, restraints, opportunities, challenges, and competitive scenario to build our analysis.

Data Collection Matrix

|

Data Collection Matrix |

Supply Side |

Demand Side |

|

Primary Data Sources |

|

|

|

Secondary Data Sources |

|

|

Market Modeling and Forecasting

We use epidemiology and capital equipment-based models to forecast market size of different segments at country and regional level.

- Epidemiology-based Forecasting Model: This method uses epidemiology data gathered through various publications and from physicians to estimate population of patients, flow of treatment of individual disease and therapies. The data collected through this method includes statics on incidence of disease, population suffering from disease, and treatment population. This method is used to understand:

- Number of patients for particular device or medical procedure and

- Repeated use of particular device depending on health and condition of patient

- Capital-based Forecasting Model: This method of forecasting is based on number of replacements, installed-based and new sales of capital equipment used in various healthcare and diagnostic centers. These three parameters are calculated and forecast is developed. Installation base is calculated as average number of units per facility; while sales for particular year is calculated from number of new and replace units. Secondary data is collected through various supply chain intermediaries and opinion leaders to arrive at installation and sales rate. These techniques help our analysts in validating market and developed market estimates and forecast.

We do forecast on basis of several parameters such as market drivers, market opportunities, industry trends government regulations, raw materials supply and trade dynamics to ensure relevance of forecast with market scenario. With increasing need to granulized information, we used bottom-up methodology for forecasting where we evaluate each regional segment differently and combined all forecast to develop final market forecast.

Data Validation

We believe primary research is a very important tool in analyzing and forecasting different markets. In order to make sure accuracy of our findings, our team conducts primary interviews at every stage of research to gain deep insights into current business environment and future trends and key developments in market. This includes use of various methods such as telephonic interviews, focus groups, face to face interviews and questionnaires to validate our research from all aspects. We validate our data through primary research from key industry leaders such as CEO, product managers, marketing managers, suppliers, distributors, and consumers are frequently interviewed. These interviews provide valuable insights which help us to have better market understanding besides validating our estimates and forecast.

Data Triangulation

Industry Analysis

|

Qualitative Data |

Quantitative Data (2017-2025) |

|

|