Microencapsulation Market By Application - Global Industry Analysis and Forecast to 2022

Published On : November 2017 Pages : 75 Category: Biotechnology Report Code : HC11351

- Industry Outlook and Trend Analysis

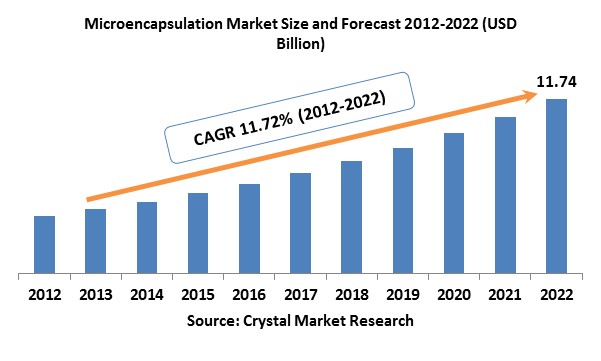

The Microencapsulation Market was worth USD 3.88 billion in the year of 2017 and is expected to reach approximately USD 11.74 billion by 2022, while registering itself at a compound annual growth rate (CAGR) of 11.72% during the forecast period. The worldwide microencapsulation market is anticipated to encounter substantial development in detergents and pharmaceutical, food & beverage industry by virtue of its interest for dynamic fixing insurance and controlled discharge in such applications. The business comprises of many manufacturers, and these participants are required to build up vital associations with the purchasers over the prime application portions. High investments in Research and Development combined with new product advancement are anticipated to be the key methodologies for the business players to tap the rising interest for end-use ventures. The United States represented a noteworthy share in the microencapsulation market attributable to the booming production base of dominating pharmaceutical organizations including Merck & Co, Pfizer and Johnson & Johnson. Additionally, developing demand for additives because of including nutritious substance and conferring flavor and shading highlights in nourishment and refreshment industry is probably going to boost the development. Reduced labor price combined with the high development of pharmaceutical, food processing and detergent & cleaners industry in Asia Pacific when contrasted with North America and Europe is relied upon to open new openings in the market in the area. High cost of manufacturing related with the technology combined with a solid a dependable balance of the current organizations including Encapsys LLC, BASF SE, and Bayer AG is relied upon to represent a challenge for the new players. The expanding prominence of oral drug deliveries and functional foods are other crucial elements, which are relied upon to increase microencapsulation development. Nonetheless, the prominence of nanotechnology in the pharmaceutical business is required to negatively affect industry.

Application Outlook and Trend Analysis

Household product was the quickest developing portion of the business and is represented more than 5 percent of the general market. Advantages, for example, smooth cleansing action, long lasting fragrance and antimicrobial treatment offered by the innovation are relied upon to drive demand. Pharmaceutical application ruled the business and is anticipated to develop at a significant pace in the upcoming years. Benefits including taste masking, sustained drug release, core ingredient protection and targeted delivery rendered by the technology are anticipated to impel development in the pharmaceutical application. The requirement for the technology in agrochemicals is anticipated to develop at a substantial pace in the following years. Microencapsulation of the active ingredients in herbicides or fertilizers provides longer protection of product, controlled synthetic discharge and expanded viability, which is anticipated to drive request. Also, fuse of the technology in paints and coatings offers good adhesive properties and corrosion protection, which is anticipated to open new roads for the business development throughout the following years. Rising demand for microencapsulation in different applications including paints and coatings, electronic inks are anticipated to positively affect the business development. The expanding utilization of electronic display equipment including mobile phones, and tablets is foreseen to build the use of electronic inks accordingly driving the market development.

Regional Outlook and Trend Analysis

In 2017 North America was the biggest market for microencapsulation and represented more than 35 percent of the general request. The powerful production base of red meat fabricates, for example, Cargill Foods, Tyson, National Beef and JBF in the United States is anticipated to increase interest for food additives, which thusly is anticipated to boost the innovation development over the figure time frame. Europe has been a key market for the innovation and is anticipated to develop at a significant pace in the following years. Increasing prominence of functional foods combined with the positive market viewpoint of cutting edge PCM in Europe is required to spur the demand of microencapsulation. The requirement for microencapsulation in Asia Pacific is foreseen to develop at the quickest rate because of the fast development of food processing and pharmaceutical industry in India, China and Japan. Developing detergents market in the area inferable from application development in household items, for example, cleansers and detergents is foreseen to boost microencapsulation demand.

Competitive insights

In August 2017, Appvion, Inc., sold its Encapsys microencapsulation section to an offshoot of Sherman Capital Holdings LLC for USD 208 million. With this understanding, Encapsys will proceed to make and offer microcapsules to Appvion for its carbonless paper creating business. The major players in the market are Lipo Technologies, Balchem Corporation, Taste Tech Ltd, Ronald T. Dodge Co., Aveka, Inc, Dow Corning Corporation, Microtek Laboratories, Capsulae, GAT Microencapsulation GmbH and InnoBio.

The global Microencapsulation Market is segmented as follows-

By Application:

- Household product

- Food additive

- Pharmaceutical

- Phase change material (PCM)

- Food additive

By Region

- North America

- U.S

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- Japan

- China

- Australia

- India

- South Korea

- Rest of Asia Pacific

- Rest of the World

- Brazil

- South Africa

- Saudi Arabia

- United Arab Emirates

- Others

Some of the key questions answered by the report are:

- What was the market size in 2017 and forecast from 2017 to 2022?

- What will be the industry market growth from 2017 to 2022?

- What are the major drivers, restraints, opportunities, challenges, and industry trends and their impact on the market forecast?

- What are the major segments leading the market growth and why?

- Which are the leading players in the market and what are the major strategies adopted by them to sustain the market competition?

Market Classification

- Microencapsulation Market, By Application, Estimates and Forecast, 2012-2022 ($Million)

- Pharmaceuticals

- Household Products

- Agrochemicals

- Food additives

- Phase Change Materials (PCM)

- Other Applications

- Microencapsulation Market, By Region, Estimates and Forecast, 2012-2022 ($Million)

- North America

- North America Microencapsulation Market, By Country

- North America Microencapsulation Market, By Application

- U.S. Microencapsulation Market, By Application

- Canada Microencapsulation Market, By Application

- Mexico Microencapsulation Market, By Application

-

- Europe

- Europe Microencapsulation Market, By Country

- Europe Microencapsulation Market, By Application

- Germany Microencapsulation Market, By Application

- France Microencapsulation Market, By Application

- UK Microencapsulation Market, By Application

- Italy Microencapsulation Market, By Application

- Spain Microencapsulation Market, By Application

- Rest of Europe Microencapsulation Market, By Application

-

- Asia-Pacific

- Asia-Pacific Microencapsulation Market, By Country

- Asia-Pacific Microencapsulation Market, By Application

- Japan Microencapsulation Market, By Application

- Australia Microencapsulation Market, By Application

- India Microencapsulation Market, By Application

- South Korea Microencapsulation Market, By Application

- Rest of Asia-Pacific Microencapsulation Market, By Application

- Asia-Pacific

-

- Rest of the World

- Rest of the World Microencapsulation Market, By Country

- Rest of the World Microencapsulation Market, By Application

- Brazil Microencapsulation Market, By Application

- South Africa Microencapsulation Market, By Application

- Saudi Arabia Microencapsulation Market, By Application

- Turkey Microencapsulation Market, By Application

- United Arab Emirates Microencapsulation Market, By Application

- Others Microencapsulation Market, By Application

- Rest of the World

Table of Contents

1. Introduction

1.1. Report Description

1.2. Research Methodology

1.2.1. Secondary Research

1.2.2. Primary Research

2. Executive Summary

2.1. Key Highlights

3. Market Overview

3.1. Introduction

3.1.1. Market Definition

3.1.2. Market Segmentation

3.2. Market Dynamics

3.2.1. Drivers

3.2.1.1. Positive Pharmaceutical Industry Outlook

3.2.1.2. Broad Application Scope in Food & Beverage Industry

3.2.1.3. Growing Detergents Market in Asia Pacific

3.2.2. Restraints

3.2.2.1. Threat of Substitutes

3.2.3. Opportunities

3.2.3.1. Emerging Markets to Offer Lucrative Growth Opportunities

4. Microencapsulation Market, By Application

4.1. Introduction

4.2. Microencapsulation Market Assessment and Forecast, By Application, 2012-2022

4.3. Pharmaceuticals

4.3.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

4.4. Household products

4.4.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

4.5. Agrochemicals

4.5.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

4.6. Food additives

4.6.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

4.7. Phase Change Materials (PCM)

4.7.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

4.8. Other Applications

4.8.1. Market Assessment and Forecast, By Region, 2012-2022 ($Million)

5. Microencapsulation Market, By Region

5.1. Introduction

5.2. Microencapsulation Market Assessment and Forecast, By Region, 2012-2022 ($Million)

5.3. North America

5.3.1. Market Assessment and Forecast, By Country, 2012-2022 ($Million)

5.3.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

5.3.3. U.S.

5.3.3.1. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

5.3.4. Canada

5.3.4.1. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

5.3.5. Mexico

5.3.5.1. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

5.4. Europe

5.4.1. Market Assessment and Forecast, By Country, 2012-2022 ($Million)

5.4.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

5.4.3. Germany

5.4.3.1. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

5.4.4. France

5.4.4.1. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

5.4.5. UK

5.4.5.1. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

5.4.6. Italy

5.4.6.1. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

5.4.7. Spain

5.4.7.1. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

5.4.8. Rest of Europe

5.4.8.1. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

5.5. Asia-Pacific

5.5.1. Market Assessment and Forecast, By Country, 2012-2022 ($Million)

5.5.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

5.5.3. Japan

5.5.3.1. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

5.5.4. China

5.5.4.1. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

5.5.5. Australia

5.5.5.1. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

5.5.6. India

5.5.6.1. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

5.5.7. South Korea

5.5.7.1. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

5.5.8. Rest of Asia-Pacific

5.5.8.1. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

5.6. Rest of the World

5.6.1. Market Assessment and Forecast, By Country, 2012-2022 ($Million)

5.6.2. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

5.6.3. Brazil

5.6.3.1. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

5.6.4. Turkey

5.6.4.1. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

5.6.5. Saudi Arabia

5.6.5.1. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

5.6.6. South Africa

5.6.6.1. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

5.6.7. United Arab Emirates

5.6.7.1. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

5.6.8. Others

5.6.8.1. Market Assessment and Forecast, By Application, 2012-2022 ($Million)

6. Company Profiles

6.1. Capsulae

6.1.1. Business Overview

6.1.2. Product Portfolio

6.1.3. Key Financials

6.1.4. Strategic Developments

6.2. LycoRed Group

6.2.1. Business Overview

6.2.2. Product Portfolio

6.2.3. Key Financials

6.2.4. Strategic Developments

6.3. BASF SE

6.3.1. Business Overview

6.3.2. Product Portfolio

6.3.3. Key Financials

6.3.4. Strategic Developments

6.4. Balchem

6.4.1. Business Overview

6.4.2. Product Portfolio

6.4.3. Key Financials

6.4.4. Strategic Developments

6.5. Lipo Technologies

6.5.1. Business Overview

6.5.2. Product Portfolio

6.5.3. Strategic Developments

6.6. Encapsys

6.6.1. Business Overview

6.6.2. Product Portfolio

6.6.3. Strategic Developments

6.7. AVEKA Group

6.7.1. Business Overview

6.7.2. Product Portfolio

6.7.3. Strategic Developments

6.8. Reed Pacific Pty. Ltd

6.8.1. Business Overview

6.8.2. Product Portfolio

6.8.3. Strategic Developments

6.9. Microtek Laboratories, Inc.

6.9.1. Business Overview

6.9.2. Product Portfolio

6.9.3. Strategic Developments

6.10. TasteTech Ltd.

6.10.1. Business Overview

6.10.2. Product Portfolio

6.10.3. Strategic Developments

6.11. GAT Microencapsulation GmbH

6.11.1. Business Overview

6.11.2. Product Portfolio

6.11.3. Key Financials

6.11.4. Strategic Developments

List of Tables

List of Tables

Table 1.Microencapsulation Market, By Application ($Million), 2012-2022

Table 2.Pharmaceuticals Market, By Region ($Million), 2012-2022

Table 3.Household products Market, By Region ($Million), 2012-2022

Table 4.Agrochemicals Market, By Region ($Million), 2012-2022

Table 5.Food additives Market, By Region ($Million), 2012-2022

Table 6.Phase Change Materials (PCM) Market, By Region ($Million), 2012-2022

Table 7.Other Applications Market, By Region ($Million), 2012-2022

Table 8.North America Microencapsulation Market, By Country, 2012-2022 ($Million)

Table 9.North America Microencapsulation Market, By Application, 2012-2022 ($Million)

Table 10.U.S.Microencapsulation Market, by Application, 2012-2022 ($Million)

Table 11Canada Microencapsulation Market, By Application, 2012-2022 ($Million)

Table 12.Mexico Microencapsulation Market, By Application, 2012-2022 ($Million)

Table 13.Europe Microencapsulation Market, By Country, 2012-2022 ($Million)

Table 14.Europe Microencapsulation Market, By Application, 2012-2022 ($Million)

Table 15.Germany Microencapsulation Market, By Application, 2012-2022 ($Million)

Table 16.France Microencapsulation Market, By Application, 2012-2022 ($Million)

Table 17.UK Microencapsulation Market, By Application, 2012-2022 ($Million)

Table 18.Italy Microencapsulation Market, By Application, 2012-2022 ($Million)

Table 19.Spain Microencapsulation Market, By Application, 2012-2022 ($Million)

Table 20.Rest of Europe Microencapsulation Market, By Application, 2012-2022 ($Million)

Table 21.Asia-Pacific Microencapsulation Market, By Country, 2012-2022 ($Million)

Table 22.Asia-Pacific Microencapsulation Market, By Application, 2012-2022 ($Million)

Table 23.Japan Microencapsulation Market, By Application, 2012-2022 ($Million)

Table 24.China Microencapsulation Market, By Application, 2012-2022 ($Million)

Table 25.Australia Microencapsulation Market, By Application, 2012-2022 ($Million)

Table 26.India Microencapsulation Market, By Application, 2012-2022 ($Million)

Table 27.South Korea Microencapsulation Market, By Application, 2012-2022 ($Million)

Table 28.Rest of Asia-Pacific Microencapsulation Market, By Application, 2012-2022 ($Million)

Table 29.Rest of the World Microencapsulation Market, By Country, 2012-2022 ($Million)

Table 30.Rest of the World Microencapsulation Market, By Application, 2012-2022 ($Million)

Table 31.Brazil Microencapsulation Market, By Application, 2012-2022 ($Million)

Table 32.Turkey Microencapsulation Market, By Application, 2012-2022 ($Million)

Table 33.Saudi Arabia Microencapsulation Market, By Application, 2012-2022 ($Million)

Table 34.South Africa Microencapsulation Market, By Application, 2012-2022 ($Million)

Table 35.United Arab Emirates Microencapsulation Market, By Application, 2012-2022 ($Million)

Table 36.Others Microencapsulation Market, By Application, 2012-2022 ($Million)

Table 37.Capsulae: Key Strategic Developments, 2017-2017

Table 38.LycoRed Group: Key Strategic Developments, 2017-2017

Table 39.BASF SE: Key Strategic Developments, 2017-2017

Table 40.Balchem: Key Strategic Developments, 2017-2017

Table 41.Lipo Technologies: Key Strategic Developments, 2017-2017

Table 42.Encapsys: Key Strategic Developments, 2017-2017

Table 43.AVEKA Group: Key Strategic Developments, 2017-2017

Table 44.Reed Pacific Pty. Ltd.: Key Strategic Developments, 2017-2017

Table 45.Microtek Laboratories, Inc.: Key Strategic Developments, 2017-2017

Table 45.TasteTech Ltd.: Key Strategic Developments, 2017-2017

Table 46.GAT Microencapsulation GmbH: Key Strategic Developments, 2017-2017

List of Figures

List of Figures

Figure 1.Microencapsulation Market Share, By Application, 2017 & 2025

Figure 2Microencapsulation Market, By Region, 2017, ($Million)

Figure 3.Capsulae: Net Revenues, 2017-2017 ($Million)

Figure 4.Capsulae: Net Revenue Share, By Segment, 2017

Figure 5.Capsulae: Net Revenue Share, By Geography, 2017

Figure 6.LycoRed Group: Net Revenues, 2017-2017 ($Million)

Figure7.LycoRed Group: Net Revenue Share, By Segment, 2017

Figure8.LycoRed Group: Net Revenue Share, By Geography, 2017

Figure9.BASF SE: Net Revenues, 2017-2017 ($Million)

Figure10.BASF SE: Net Revenue Share, By Segment, 2017

Figure 11.BASF SE: Net Revenue Share, By Geography, 2017

Figure 12.Balchem: Net Revenues, 2017-2017 ($Million)

Figure 13.Balchem: Net Revenue Share, By Segment, 2017

Figure 14.Balchem: Net Revenue Share, By Geography, 2017

Figure 15.GAT Microencapsulation GmbH: Net Revenues, 2017-2017 ($Million)

Figure 16.GAT Microencapsulation GmbH: Net Revenue Share, By Segment, 2017

Figure 17.GAT Microencapsulation GmbH: Net Revenue Share, By Geography, 2017

Research Methodology

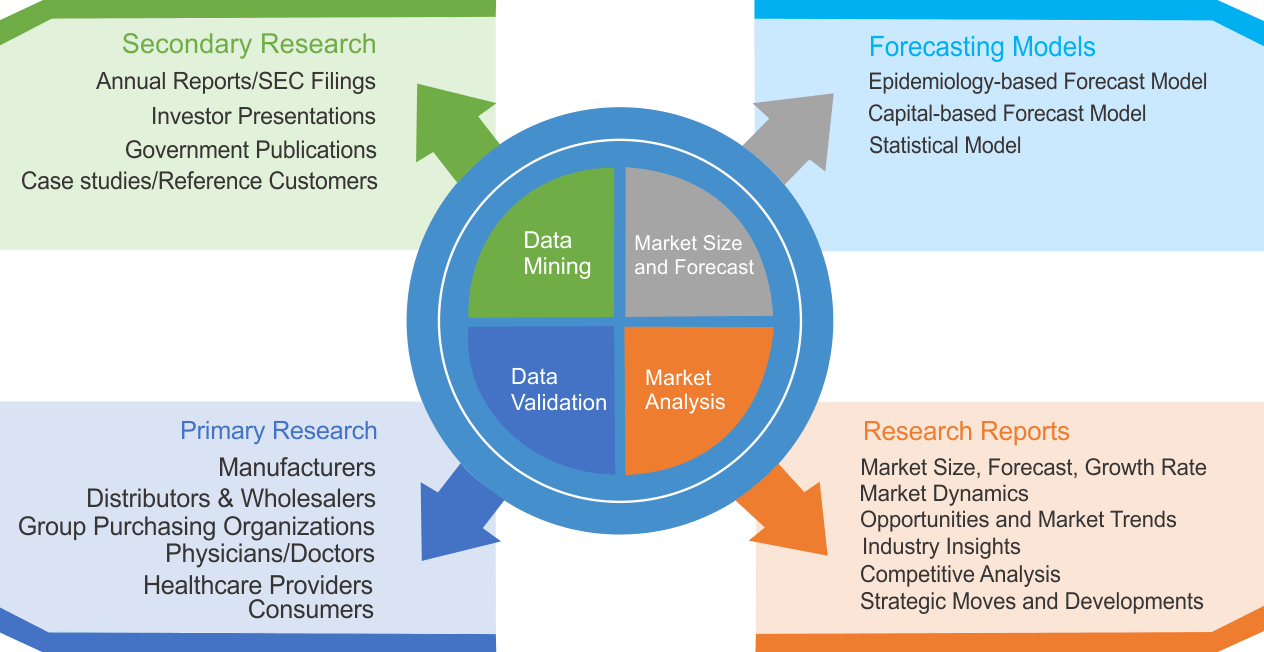

We use both primary as well as secondary research for our market surveys, estimates and for developing forecast. Our research process commence by analyzing the problem which enable us to design the scope for our research study. Our research process is uniquely designed with enough flexibility to adjust according to changing nature of products and markets, while retaining core element to ensure reliability and accuracy in research findings. We understand both macro and micro-economic factors to evaluate and forecast different market segments.

Data Mining

Data is extensively collected through various secondary sources such as annual reports, investor presentations, SEC filings, and other corporate publications. We also refer trade magazines, technical journals, paid databases such as Factiva and Bloomberg, industry trade journals, scientific journals, and social media data to understand market dynamics and industry trends. Further, we also conduct primary research to understand market drivers, restraints, opportunities, challenges, and competitive scenario to build our analysis.

Data Collection Matrix

|

Data Collection Matrix |

Supply Side |

Demand Side |

|

Primary Data Sources |

|

|

|

Secondary Data Sources |

|

|

Market Modeling and Forecasting

We use epidemiology and capital equipment-based models to forecast market size of different segments at country and regional level.

- Epidemiology-based Forecasting Model: This method uses epidemiology data gathered through various publications and from physicians to estimate population of patients, flow of treatment of individual disease and therapies. The data collected through this method includes statics on incidence of disease, population suffering from disease, and treatment population. This method is used to understand:

- Number of patients for particular device or medical procedure and

- Repeated use of particular device depending on health and condition of patient

- Capital-based Forecasting Model: This method of forecasting is based on number of replacements, installed-based and new sales of capital equipment used in various healthcare and diagnostic centers. These three parameters are calculated and forecast is developed. Installation base is calculated as average number of units per facility; while sales for particular year is calculated from number of new and replace units. Secondary data is collected through various supply chain intermediaries and opinion leaders to arrive at installation and sales rate. These techniques help our analysts in validating market and developed market estimates and forecast.

We do forecast on basis of several parameters such as market drivers, market opportunities, industry trends government regulations, raw materials supply and trade dynamics to ensure relevance of forecast with market scenario. With increasing need to granulized information, we used bottom-up methodology for forecasting where we evaluate each regional segment differently and combined all forecast to develop final market forecast.

Data Validation

We believe primary research is a very important tool in analyzing and forecasting different markets. In order to make sure accuracy of our findings, our team conducts primary interviews at every stage of research to gain deep insights into current business environment and future trends and key developments in market. This includes use of various methods such as telephonic interviews, focus groups, face to face interviews and questionnaires to validate our research from all aspects. We validate our data through primary research from key industry leaders such as CEO, product managers, marketing managers, suppliers, distributors, and consumers are frequently interviewed. These interviews provide valuable insights which help us to have better market understanding besides validating our estimates and forecast.

Data Triangulation

Industry Analysis

|

Qualitative Data |

Quantitative Data (2017-2025) |

|

|